This probably doesn’t come as a big surprise to anyone reading, but bigger isn’t always better on Wall Street. And a nice new study is here to prove it. This study by Lubos Pastor, Robert Stambaugh and Lucian Taylor shows that funds suffer as they get larger. They state:

“We empirically analyze the nature of returns to scale in active mutual fund management. We find strong evidence of decreasing returns at the industry level: As the size of the active mutual fund industry increases, a fund’s ability to out-perform passive benchmarks declines. At the fund level, all methods considered indicate decreasing returns, but estimates that avoid econometric biases are insignificant. We also find that the active management industry has become more skilled over time. This upward trend in skill coincides with industry growth, which precludes the skill improvement from boosting fund performance. Finally, we find that performance deteriorates over a typical fund’s lifetime. This result can also be explained by industry-level decreasing returns to scale.”

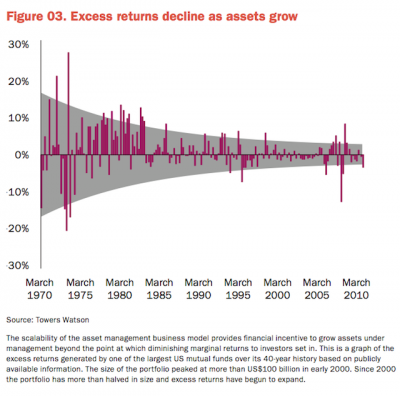

We saw the same conclusion the other day in a post via Josh Brown who cited a Towers Watson study on fund size:

From a behavioral and structural portfolio perspective there are some good lessons to learn here:

- Beware of chasing hot performers whose assets are diluting their strategies.

- Study manager strategies closely so you can avoid strategies that are more likely to become closet index funds as they grow.

- Bigger isn’t always better on Wall Street.

Source: Jason Zweig via Twitter

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.