Bill Gross, the founder of PIMCO, made waves this week by selling his holdings of US Treasuries. Bloomberg reported on the dramatic news:

“Bill Gross, who runs the world’s biggest bond fund at Pacific Investment Management Co., told PBS this week that yields are too low. His $237 billion Total Return Fund held no government-related debt as of Feb. 28, according to a report on the Pimco website.”

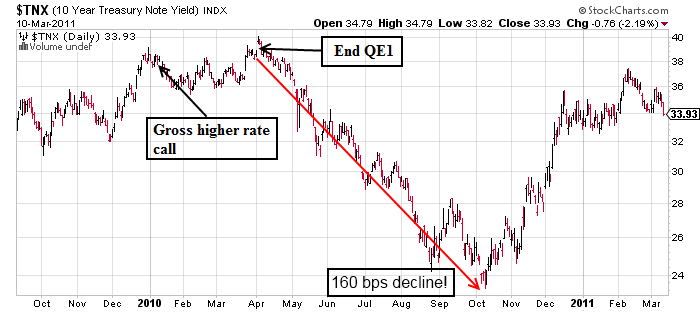

That’s dramatic. After all, Mr. Gross says the Fed is now helping the US government implement a ponzi scheme. He also believes QE is helping to dramatically reduce rates. He says the end of QE2 will be a “d-day” for the bond market. Those are comments that you’d certainly want to take notice of considering this is the largest bond manager in the world, right? Not necessarily. Unfortunately, this isn’t the first time Bill Gross has sounded the alarm for the U.S. bond market.

In early 2010 he was interviewed by TIME magazine about the economic outlook. Mr. Gross was asked about the end of QE1 and how it would impact rates. He answered:

Won’t that (the end of QE1) put upward pressure on interest rates?

“I think it will. I mean, the mortgage market would be your first place to look, in terms of something that’s overvalued that would become normalized. Nobody knows what the Fed’s buying is worth — we think about half a percentage point on rates, but we don’t know.”

What happened when QE1 ended? Rates did the exact opposite of what Mr. Gross expected. In fact, they went into a tailspin. He top ticked it to the day:

I am not sure there is much, if anything, that we can read into this move by Mr. Gross. He has been talking about some form of bear market in bonds for over 10 years now. In 2004 PIMCO declared: “We are at the end of the secular bull market in bonds.” In a 2001 letter Gross declared the bull in bonds over, but said opportunities would continue. In a 2007 interview he referred to himself as a “bear market manager”. Inbetween these calls he has consistently maintained a very healthy holding in fixed income and US Treasury correlated assets.

So, do the current opinions about “d-day” and the end of the bond bull market matter? Yes, as much as the (ever changing) headline grabbing opinions of the last 10 years….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.