Outstanding piece here in Bloomberg on QE by Peter Coy. Peter recites a common refrain from Pragmatic Capitalism about QE – it’s an asset swap. I’ll get right to the good stuff in the article:

“Quantitative easing isn’t “printing money.” If it were, the supply of money would have soared and the U.S. would have either much more economic growth or much more inflation—or probably some of each. Instead, the Fed’s purchases have merely managed to give the banking system a huge increase in unneeded reserves.

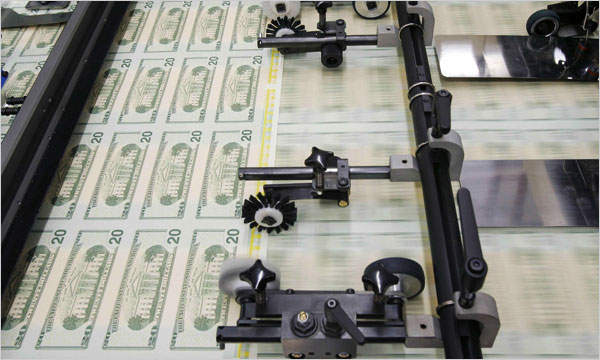

The way to increase the amount of money—and get the Bureau of Engraving and Printing to rev up its presses—is for banks to make more loans. Borrowers will put most of the money on deposit, but they will take some of it out to spend. That will increase the amount of money being passed around between buyers and sellers—i.e., in circulation. That process is largely beyond the Fed’s control.”

If you go through my brief primer on QE you might find that there’s a bit of a problem in this description. Technically, QE, which is done mostly with non-banks, does indeed increase the outstanding supply of deposits. But that’s just an extra step in the accounting and doesn’t really change the story all that much. More importantly, QE creates reserves/deposits and could technically be described as “money printing”, but also involves the “unprinting” of a T-bond or MBS thereby leaving the private sector with the same quantity of financial assets, but an altered composition. Calling this overall process “money printing” is highly misleading. The term “asset swap” is much more appropriate.

Anyhow, it’s nice to see this in a mainstream media article. Really well done by Bloomberg and Peter Coy.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.