Rates have inched up enough now that if you squint your eyes you can see the change on a 40 year chart. I say that partly in jest, but the important part is the 40 year part. Because yes, we’ve all become a bit deluded about asset returns thanks in large part to the once-in-a-lifetime change in rates from 15% to 0%.

I’ve noted on several occasions that the 60/40 stock/bond portfolio of the future is not going to look much like the 60/40 stock/bond portfolio of the past. This is just simple math that can be broken down into two finer points:

- Bonds are going to generate lower future returns therefore the big tailwind of high returns from your 40% bond piece are a thing of the past.

- Bond returns are riskier in low rate environments because they are now lower yielding instruments that expose us to more potential interest rate risk.¹

But the important part here is this – even though bonds are likely to be a worse diversifier in a rising rate environment it does not mean they aren’t a sufficient diversifier in a rising rate environment. Luckily, we have some actual historical data to support this thinking.

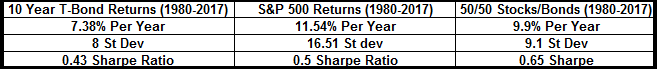

First, let’s put things in perspective by recognizing how fortunate we’ve all been thanks to the huge bond bull market. Since 1980 bonds have been spectacular diversifiers. In fact, bonds were incredible all on their own:

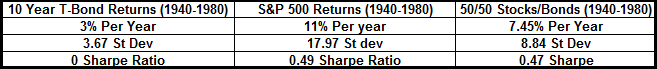

This era of high bond returns is over. But it doesn’t necessarily mean that bonds are a bad diversifier. For instance, from 1940-1980 interest rates rose steadily from about 2.5% to 15%. This seems counterintuitive to what most of us are led to believe about rising rates, but your average annual return over this period was 3% in a 10 year T-Bond. Bonds weren’t nearly as beneficial to a portfolio as they have been in recent decades, but that doesn’t mean they weren’t a good diversifier.

Let’s look at a more detailed breakdown:

So, bonds didn’t do great and had poor risk adjusted returns during this period. But they were still a low volatility asset class (assuming you owned investment grade bonds). So when you combined stocks with high quality bonds the bonds did a good job diversifying your equity risk. In other words, you generated a lower return, but you still generated a solid return with substantially less volatility than the all stock portfolio. And that’s why you own bonds – not for the sexy returns, but because they make your overall portfolio more behaviorally sustainable.

The key lesson here is this:

- Yes, bonds are going to do worse in the future than many people are used to. But the bottom line is that stocks are always very risky and even though bonds will generate lower future returns they will still generate much safer returns than stocks. And that means that bonds will still be a useful diversifier even if rates rise substantially.

¹ – Remember, it’s not the low and slow rising rate environments that hurt bonds. It’s the low and fast rising rate environments that hurt bonds the most because that forces the bond holder to sit through relatively long periods of principal losses.

NB – I know, I know. I did not adjust any of this for inflation. That’s because bonds don’t generally do a very good job protecting you from inflation. That’s why you own stocks. So, when we adjust the returns for inflation it’s better to do so when looking at a diversified portfolio. After all, that’s one of the main reasons you should always own stocks – because they protect you from inflation while your bonds protect you from equity volatility.

NB 2 – An obvious response to this might be “why not just own cash and T-Bills since they did relatively well in the 1940-1980 period?” Well, the answer is that we don’t know what’s going to happen going forward and whether rates will actually rise? If, for instance, stocks generate unusually poor returns and rates remain low (think, Japan) then owning long-term higher yielding bonds will add important incremental returns to your portfolio. So, the short answer is, don’t rely too much on backtested results and diversify specifically because we don’t know the future. 🙂

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.