In order to really understand the credit crisis and why we didn’t turn into Greece or Japan, it’s helpful to look at the components of corporate profits and why the business sector didn’t crater after 2008. Why did corporate profits surge in recent years despite the collapse in private investment (which almost always drives corporate profits)?

First, it’s helpful to review the Kalecki profits equation:

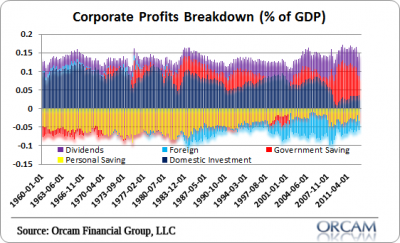

Profits = Investment – Household Savings – Government Savings – Foreign Savings + Dividends

And we can look at the components of this equation by understanding the following chart:

That dark blue column is private investment. It just about always drives profits. But when the credit crisis hit firms were hit with an unprecedented decline in aggregate demand which meant that private investment collapsed. Since the US economy runs a current account deficit and the personal saving rate is always positive, that meant that we were basically relying on dividends and the government to drive the profit picture in the 2008-2012 period. And guess who went and spent over a trillion dollars every year for 5 years? Yes, the government. And that spending went into the coffers of companies who were the direct recipients of the government’s massive spending. And as these corporations saw their balance sheets improve they hired more people, invested more, increased dividends, etc.

This is the second time in the last few weeks I’ve emphasized this point. The reason why is because I see some economists rampaging against the impact of fiscal policy trying to claim that it has no positive impact on the economy. You would be right that fiscal policy doesn’t matter. IF there were no corporations or profits in your model of the economy. But, if you think corporations and profits matter to a capitalist system then understanding that the government is, at times, a substantial driver of profits, is pretty important.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.