Sentiment was a bit more subdued this week although it remains well above historical ranges. The Bernanke Put has created an environment where almost nothing matters except the fact that the Fed is verbally propping up the market. Good news is seen as genuine good news. And bad news is seen as an excuse for the Fed to remain accommodative. They’ve put themselves in quite a bind now.

The markets are becoming conditioned to expect a Fed backstop and when that backstop is removed you can almost guarantee that the market will fall and force the Fed to re-implement the backstop. All of this has created a permanently high level of valuations and sentiment. It can be sustained, but the odds that it will eventually spiral out of control (to the upside) are increasingly high. I continue to believe that the current Fed policy is entirely unnecessary, ineffective and only adds a highly damaging psychological element to the marketplace.

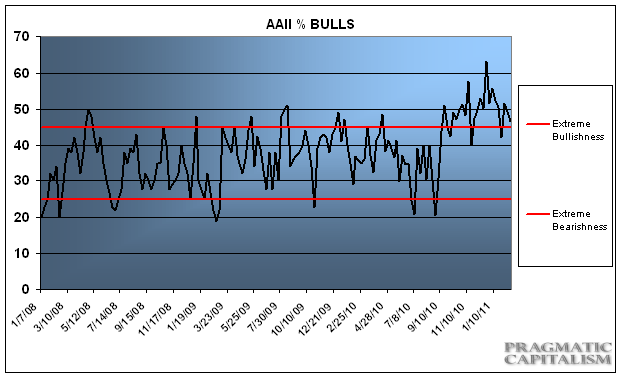

The AAII sentiment survey showed a modest decline in bullishness this week. Charles Rotblut of AAII elaborates:

“Bullish sentiment declined 2.8 percentage points to 46.6% in the latest AAII Sentiment Survey. This is the third time in four weeks that optimism has been below 50%. Nonetheless, bullish sentiment, expectations that stock prices will rise over the next six months, was above its historical average of 39% for the 24th consecutive week. This is the second longest such streak in the survey’s history.

Neutral sentiment, expectations that stock prices will stay essentially flat over the next six months, rose 4.2 percentage points to 27.9%. This is a seven-week high for neutral sentiment. Nonetheless, neutral sentiment remained below its historical average of 31% for the 28th consecutive week.

Bearish sentiment, expectations that stock prices will fall over the next six months, fell 1.3 percentage points to 25.6%. This was the 20th time in the past 23 weeks that pessimism has been below its historical average of 30%.

As stated above, bullish sentiment has come in below 50% during three out of the last four weeks. Though still high, optimism has cooled a bit from the red hot levels recorded throughout much of December and January. The continuation of the rally’s current leg, better-than-expected earnings and calm market conditions are combining to keep individual investors hopeful about the direction of stock prices.

This week’s special question asked AAII members about the current lack of volatility. (There have only been four days since December 3 when the S&P 500 has posted a daily gain or loss of greater than 1%.) Opinions varied, but many members thought the markets are currently experiencing a false sense of calm. A sizeable minority, however, thought the low level of volatility was justified.

Though the belief that there is a false sense of calm may sound like it contradicts with our weekly sentiment survey has been registering, I think it accurately portrays what many investors are feeling. Earnings and the economy are recovering, but there are still several underlying problems (unemployment, housing, the federal deficit, etc.). Thus, while there is optimism, there is also discomfort.

Here is a sampling of what AAII members said about the current lack of volatility:”

- “Although it is very encouraging, I continue to have a low level of anxiety.”

- “It’s not a false sense of calm, but more an illusion of calm. There is still some serious deleveraging going on in the economy.”

- “It’s a false sense of security. Everybody is once again believing in the miracle.”

- “It’s justified…Too many positive developments nationally and internationally with mid-term implications to ignore.”

- “I believe the lack of volatility signifies that many people may believe the good times have arrived again.”

This week’s AAII Sentiment Survey results:

- Bullish: 46.6%; down 2.8 percentage points

- Neutral: 27.9%; up 4.2 percentage points

- Bearish: 25.6%; down 1.3 percentage points

Historical averages:

- Bullish: 39%

- Neutral: 31%

- Bearish: 30%

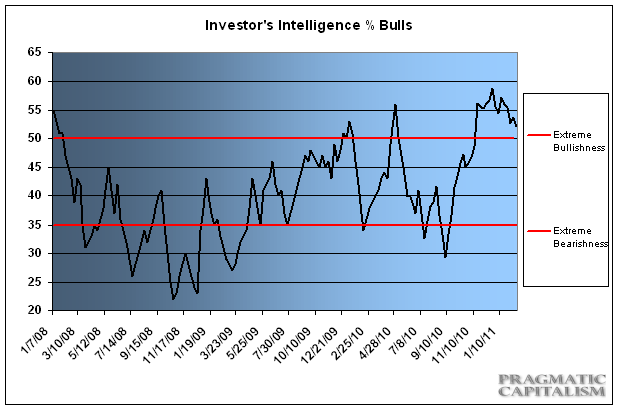

This week’s Investor’s Intelligence survey showed a similar decline from 53.7% to 52.2%. All in all, sentiment remains at a permanently high plateau as the modest recovery combines with the Bernanke Put to create what is a seemingly invulnerable market environment.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.