By Charles Rotblut, CFA, AAII

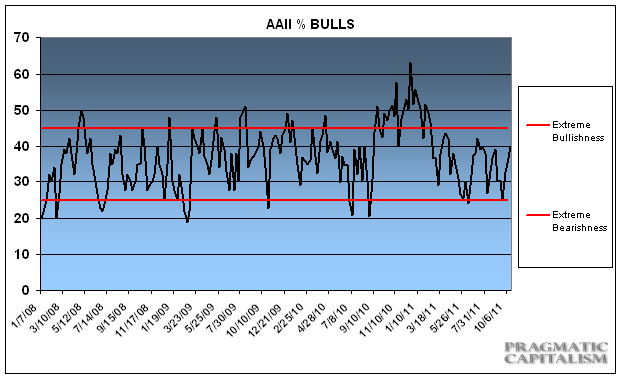

Bullish sentiment, expectations that stock prices will rise over the next six months, increased 4.5 percentage points to 39.8%. This is the highest level of optimism since July 21, 2011. It also ends a streak of 11 weeks when bullish sentiment was below its historical average of 39%.

Neutral sentiment, expectations that stock prices will be essentially unchanged over the next six months, rose 4.8 percentage points to 23.9%. This was the 13th consecutive week that neutral sentiment has been below its historical average of 31%.

Bearish sentiment, expectations that stock prices will fall over the next six months, plunged 9.4 percentage points to 36.4%. This is a six-week low for pessimism. It is also only the third time in the past 11 weeks that bearish sentiment has been below 40%. Despite this week’s decrease, pessimism is above its historical average of 30% for the 31st time out of the last 34 weeks.

The Dow Jones Industrial Average has jumped 8% higher from its October 3 close, and this rebound has alleviated some of the pessimism. Though a greater percentage of investors are looking for stocks to rise over the next six months, AAII members remain very cautious, as is evident by the above-average level of bearish sentiment. The pace of economic growth, worries about European sovereign debt, frustration with Washington and volatile market conditions are weighing on individual investors’ moods.

This week’s special question asked AAII members if they have recently begun bargain shopping for stocks. The majority of respondents said they had not. Several, however, said they would consider bargain shopping if prices fell by an additional 10% to 20%. Others were either waiting on factors beside price movement or simply had no intentions of buying stocks right now. A sizeable minority, however, said they have recently been bargain shopping for stocks.

Here is a sampling of the responses:

- · “No. Nothing has been resolved in Europe, and I expect lower guidance from U.S. companies.”

- · “I am not bargain hunting because the market will be down a lot in six months.”

- · “I am looking, but I will not be buying without another drop of 5% to 15%.”

- · “I have a cash position of more than 20% and will invest in stocks when they drop 10% from current levels.”

- · “No hunting yet, but I will soon be scouting the grounds for trophy picks.”

- · “I started in July and have been buying stocks ever since then.”

This week’s AAII Sentiment Survey results:

- · Bullish: 39.8%, up 4.5 percentage points

- · Neutral: 23.9%, up 4.8 percentage points

- · Bearish: 36.4%, down 9.4 percentage points

Historical averages:

- Bullish: 39%

- Neutral: 31%

- Bearish: 30%

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.