By Charles Rotblut, CFA, AAII

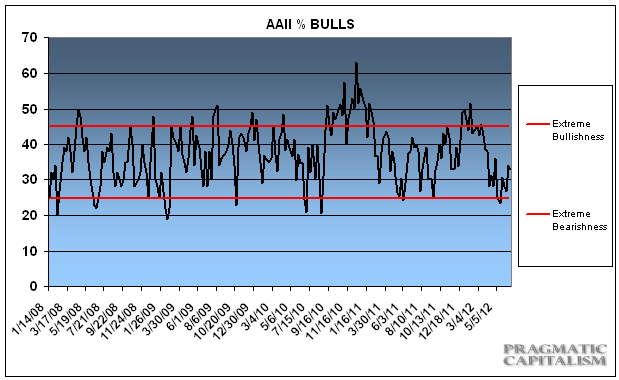

Bullish sentiment declined slightly, while bearish sentiment was essentially unchanged in the latest AAII Sentiment Survey.

Bullish sentiment, expectations that stock prices will rise over the next six months, declined 1.1 percentage points to 32.9%. This is the 12th consecutive week that bullish sentiment has been below its historical average of 39%.

Neutral sentiment, expectations that stock prices will fall over the next six months, rose 1.1 percentage points to 31.2%. This puts it about even with the historical average of 31%.

Bearish sentiment, expectations that stock prices will fall over the next six months, edged up 0.1 percentage points to 35.9%. This is the 10th time in 11 weeks that bearish sentiment has been above its historical average of 30%.

This is the longest streak of consecutive below-average readings for bullish sentiment since a 14-week stretch from December 20, 2007, through March 20, 2008. Many individual investors remain fearful that further declines in stock prices could occur. Worries that the European sovereign debt crisis and a slower pace of U.S. economic growth will lead to a repeat of last summer’s correction are keeping pessimism at above-average levels.

This week’s special question asked what the Federal Open Market Committee should do over the next few months, if anything, to help the U.S. economy. (The results were tabulated before yesterday’s FOMC meeting statement was released.) Most respondents said the Fed should do nothing. The reasons varied from a belief that additional stimulus won’t help to worries about the potentially negative effects that previous stimulus actions will have to opinions that the Fed should wait for events in Europe and the November elections to unfold.

Among the small number of respondents who thought the Fed should act, most thought more stimulus should be provided. Some, however, thought the Fed should allow interest rates to rise.

Here is a sampling of the responses:

· “No additional quantitative easing. I doubt it will work.”

· “Nothing. The Fed has done enough.”

· “Leave us alone and stop printing money.”

· “Nothing, other than continuing to watch the economy and being prepared to act.”

· “I don’t think Bernanke has many options left.”

This week’s AAII Sentiment Survey results:

· Bullish: 32.9%, down 1.1 percentage points

· Neutral: 31.2%, up 1.1 percentage points

· Bearish: 35.9%, up 0.1 percentage points

The AAII Sentiment Survey has been conducted weekly since July 1987 and asks AAII members whether they think stock prices will rise, remain essentially flat, or fall over the next six months. The survey period runs from Thursday (12:01 a.m.) to Wednesday (11:59 p.m.). The survey and its results are available online at: https://www.aaii.com/sentimentsurvey.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.