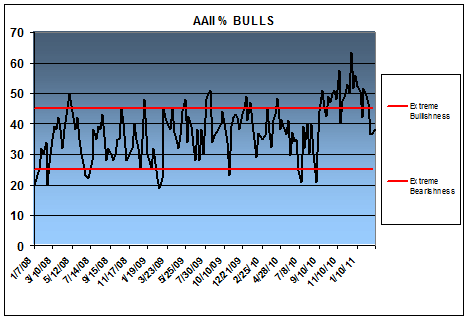

This week’s sentiment readings were mixed again with the AAII reporting a slight decline in bullish sentiment and Investor’s Intelligence reporting a slight gain. Charles Rotblut of AAII elaborates on the AAII report:

“Bullish sentiment slipped 0.8 percentage points to 36.0% in the latest AAII Sentiment Survey. Optimism that stock prices will rise over the next six months is at its lowest level since September 2, 2010. The historical average is 39%.

Neutral sentiment, expectations that stock prices will remain essentially flat over the next six months, rose 1.7 percentage points to 31.7%. This is the first time neutral sentiment has been above its historical average of 31% since August 5, 2010.

Bearish sentiment, expectations that stock prices will fall over the six next months, declined 0.8 percentage points to 32.3%. This is the third consecutive week that pessimism has been above its historical average of 30%.

In a word, individual investors remain split over the short-term direction of stock prices. Though slightly more AAII members are optimistic than pessimistic, bullish sentiment remains below its historical average. This is occurring as the S&P 500 has stayed within an approximate 3% trading range since late February. The numbers reflect both recognition of stronger corporate earnings and unease about the threat of higher inflation and interest rates.”

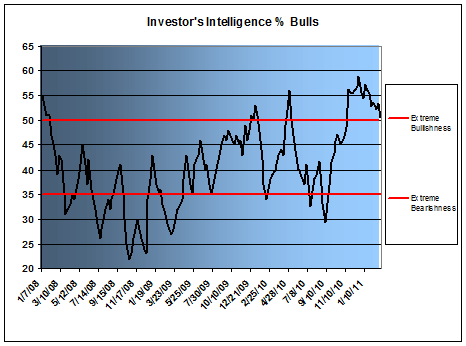

This week’s Investor’s Intelligence survey showed a jump in bullishness to 52.2%. This was a 1.6% increase over last week. Overall, these levels are still consistent with high levels of optimism.

All in all, small investors remain skittish, but advisors are steadfast in their bullish belief about equity prices.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.