Warren Buffett once said: “investing is simple, but not easy”. Given his love of cheeseburgers and Diet Coke and also being 87 years old, he might not agree with this analogy, but I’ve compared investing to getting healthy. Being healthy is simple, but not easy. That is, we all know that you eat right and workout. That’s simple. But it’s really hard to avoid cheeseburgers while also maintaining a strict workout schedule.

One of the simple things we always hear about is how the key to good investing is “buying low and selling high”. I was reminded of this the other day when reading a particularly a bad take on buybacks. Yeah, I know it’s fun to hate on buybacks, but most of that hate is misguided or at least misconstrued. For instance, companies catch a lot of flak because they tend to initiate buybacks when the market is booming and tend not to buyback shares when the market is tanking. But this makes perfect sense because cash flows are procyclical and you have excess cash flow in the good times and a lack of cash flow during bad times. So companies naturally end up buying back more shares during good times and fewer shares during bad times.

But this same thinking can be applied to investing in a more general sense. It’s actually very hard to buy low and sell high due to the following rational reasons:

- We don’t really know where the lows are.

- We are all scared shitless at the lows.

- The procyclical nature of cash flows makes it harder to buy low.

Let’s look at each point a little more closely:

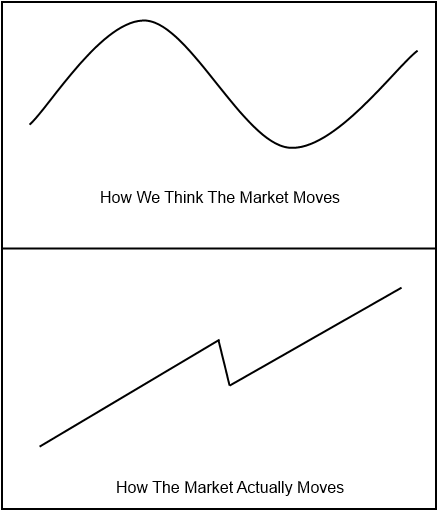

1. We don’t really know where the lows are. We tend to think that the markets move like a sine wave, but they don’t really. They tend to move more like a linear trend with occasional disruptions. Think, this:

Knowing when you’re not in the upward trend (but actually at the lows) is extremely hard because the lows are relatively short-lived and impossible to time consistently. We’re mostly just trending higher as things slowly improve and corporate America chugs forward. There are occasional disruptions, but if you pan out to 40,000 feet those disruptions look relatively minor inside of the much longer trend that’s occurring.

2. We are all scared shitless at the lows. I don’t care who you are, but if you lived through 2008 you were scared shitless at some point. It’s totally natural. The financial markets are this kinda real, kinda fictitious thing that no one fully understands. So when it starts to feel uncomfortable it’s natural to doubt its sustainability. And the natural feeling in the depths of a downturn is to assume the worst.

In 2008 when we were down 50% most of us were wondering if we were halfway down to a Great Depression style 90% decline in the stock market. It’s really hard to put money at risk when everything feels like it’s falling apart. Our tendency, as hairless apes, is to survive at all cost and so our natural urge is flight over fight.

3. The procyclical nature of cash flows makes it harder to buy low. When the markets go through real declines there’s usually a real economic event occurring. In 2008 there was a real recession that was occurring as the stock market collapsed. So when the market starts to anticipate economic weakness it declines because people are de-risking in order to prepare for leaner times. It’s during these times that cash flows tend to dry up because economic activity slows, people lose their jobs and you don’t want to incur principal losses in some of your more liquid assets (like stocks).

It’s during times like these that you know you should be buying low, but you can’t because you don’t have the cash flow available to take advantage of the environment.

There are ways to combat this to some degree. Personally, I prefer a more countercyclical approach that systematically instills discipline in the asset allocation process. It’s also why diversification works – the less procyclical you make your portfolio the more behaviorally and economically resilient it is. Now, go enjoy a cheeseburger and then follow it up with 20 countercyclical salads and 100 sit-ups. See, isn’t that easy?¹

¹ – The author is not sure if he can do sit-ups anymore. But he can definitely eat cheeseburgers.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.