Here’s a nice new piece of research from the Bank of England that researches the size of the banking system relative to the rest of the economy and whether that can be problematic. They found:

· As a share of GDP, the UK banking system is larger than the United States, Japan and the ten largest EU countries (see infographic below). This article considers why it is so big, and how much further it could grow.

· The article also uses cross-country data to investigate: is size is a good predictor of banking crises? And did economies with larger banking systems suffer greater output losses – or incur greater fiscal costs – following the 2007-08 crisis?

It makes sense that an economy with a larger banking system relative to total output could become potentially more fragile. But it’s not all just about size, but quality. A banking system isn’t fragile just because it is large. It becomes fragile when the quality of its assets are low. This is what made the sub-prime crisis so dangerous. It was the incredible growth in the banking system and our dependence on this system combined with the increasingly unstable nature of the assets that made up that banking system.

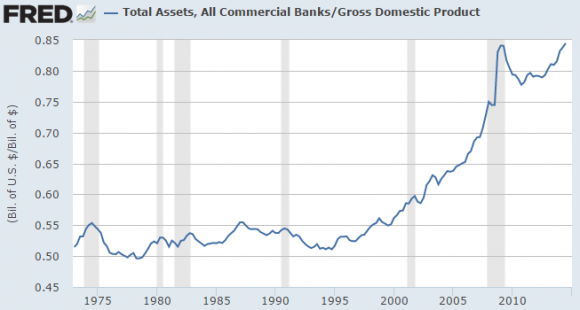

In the USA there’s no doubt that there’s been incredible growth in the banking system over the last 30 years.

But this growth alone doesn’t tell us anything about the quality of that growth. And the problem is that evaluating the “quality” of assets depends on who’s doing the analysis. For instance, one of the problems with the recent financial crisis was that banks thought the loans they were making and repackaging were higher rated loans than they really were.

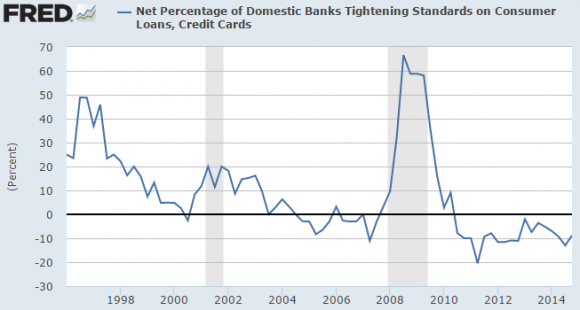

One thing we know for certain is that the banking system has become structurally important to the economy and increasingly risky because of the various ways in which money center banks rely on various higher risk lines of business. Throw in the chase for profits and the cyclical nature of lending standards (see below) and we have very real reason to be concerned about the way we are all coming to depend on the stability of an increasingly unstable part of the monetary system.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.