In the footnotes of my last post on factor investing I asked if I was being too skeptical:

Maybe I’ve read too much Carl Sagan who once said:

“If we are not able to ask skeptical questions, to interrogate those who tell us that something is true, to be skeptical of those in authority, then, we are up for grabs for the next charlatan (political or religious) who comes ambling along.”

This is a very stupid comment. There is no such thing as reading too much Carl Sagan. I also don’t think there’s such a thing as too much skepticism. So, now that I’ve laid the foundation to rip factor investing some more let’s get even more skeptical.

The 4 big factors are value, size, momentum and quality. Now, in my last post I said that the track record of factors isn’t very good. I cited the SPIVA scorecard which judges a lot of size and value funds. Admittedly, this is an imprecise measure as many of these funds do not implement these factors in standard ways. But since there haven’t been many live factor funds around it’s very hard to judge the performance so far. After all, we know these strategies work in the backtested hypotheticals, but making a strategy work in real-time is much more difficult.

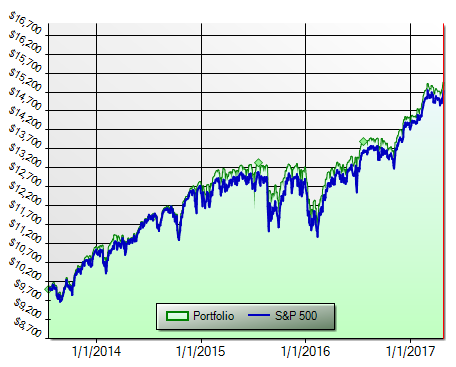

Now, in my last post I said that I am not against factor investing if it can be done in a tax and fee efficient manner. Turns out, we’re getting closer and closer to a point where we can actually judge some live factor funds over a decent time horizon. So, for instance, iShares has 4 big factor funds that are all very reasonably priced at 0.15% (VLUE, SIZE, MTUM and QUAL). If we equal weight them we have almost 4 years of performance to test. Here’s the result:

This makes sense. We own so many factors here that we start to look almost exactly like the S&P 500. On a risk adjusted basis you actually did slightly worse owning the 4 factor portfolio (Sharpe of 1.18 vs 1.2 for SPY). Still, the message is clear – if you own too many factors you start to look too much like the market cap weighted portfolio. This leaves us in a bind. If we shouldn’t own them all (because that just results in excess fees) then we need to pick the ones we think will create some alpha.

As it turns out, the only factor that outperformed the S&P over this period by a reasonable amount was MTUM. So, you had to pick the right factor to invest in for this strategy to succeed. You had a 25% chance of being right. And this is where my skepticism really grows. We know that people are bad at picking stocks. We also know that they are bad at picking the best fund managers. So why in the world do we think we can pick the best factor?

Maybe I am being unfairly critical here. I don’t know. So far there isn’t enough live data to confirm that factor investing really works better than market cap weighting. Maybe that will change with time and I can be convinced. But I don’t feel like paying extra fees waiting to find out if my faith (belief in the absence of real evidence) is right.

NB – To be perfectly clear here, it is not the more active part of factor investing that bothers me. Deviating from global cap weighting is a smart thing to do at times if you’re tax and fee effiicient. What bothers me is the hope of excess return in exchange for the guarantee of higher fees. This is hardly a problem when attached to a 15 bps fee, but too many advisors and fund managers sell these strategies wrapped in 1%+ advisory/management fees. To me, that smells like a very bad deal.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.