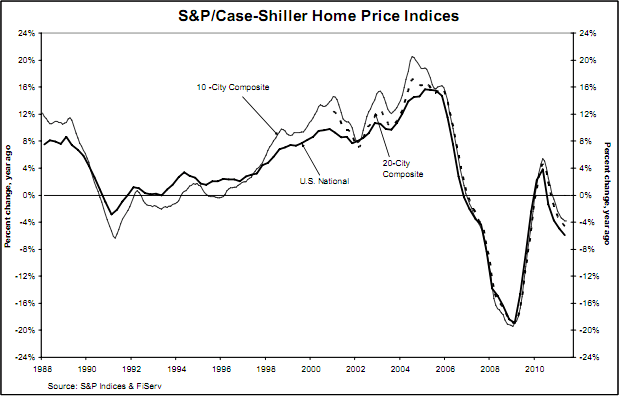

This morning’s Case Shiller housing data was a bit of a mixed bag. As is generally the case this time of year, housing prices showed some signs of stability. This resulted in a 3.6% increase in prices during Q1 after the 4.1% decline in Q1. David Blitzer, Chairman of the Index Committee at S&P elaborated on the report:

“This month’s report showed mixed signals for recovery in home prices. No cities made new lows in June 2011, and the majority of cities are seeing improved annual rates. The National Index was up 3.6% from the 2011 first quarter, but down 5.9% compared to a year-ago.

Looking across the cities, eight bottomed in 2009 and have remained above their lows. These include all the California cities plus Dallas, Denver and Washington DC, all relatively strong markets. At the other extreme, those which set new lows in 2011 include the four Sunbelt cities – Las Vegas, Miami, Phoenix and Tampa – as well as the weakest of all, Detroit. These shifts suggest that we are back to regional housing markets, rather than a national housing market where everything rose and fell together.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.