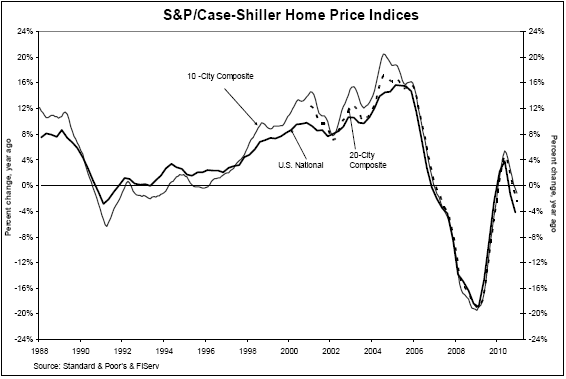

This morning’s Case/Shiller housing data confirms what we have long feared – the housing double dip is here.

Data through December 2010, released today by Standard & Poor’s for its S&P/Case-Shiller1 Home Price Indices, the leading measure of U.S. home prices, show that the U.S. National Home Price Index declined by 3.9% during the fourth quarter of 2010. The National Index is down 4.1% versus the fourth quarter of 2009, which is the lowest annual growth rate since the third quarter of 2009, when prices were falling at an 8.6% annual rate. As of December 2010, 18 of the 20 MSAs covered by S&P/Case-Shiller Home Price Indices and both monthly composites were down compared to December 2009. Both Los Angeles and San Francisco reported negative annual rates of return in December, leaving San Diego and Washington DC as the only two cities where home prices are increasing on a year-over-year basis, +1.7% and +4.1%, respectively.

David Blitzer of S&P elaborated on the results:

“We ended 2010 with a weak report. The National Index is down 4.1% from the fourth quarter of 2009

and 18 of 20 cities are down over the last 12 months. Both monthly Composites and the National Index

are moving closer to their 2009 troughs. The National Index is within a percentage point of the low it set

in the first quarter of 2009. Despite improvements in the overall economy, housing continues to drift

lower and weaker.”

As Ben Bernanke touts the rise of equities he conveniently ignores the continuing decline in the consumer’s largest asset. This morning’s report shows that QE is having little to no impact on the real economy as the real estate market remains mired in a deep recession. We are likely to see some seasonal strength later this spring and summer, however, the fundamentals for the national housing market remain very poor as the supply/demand imbalance remains.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.