Disaggregation of credit is the understanding that there are good forms of credit and bad forms of credit. A good form of credit is something like a standard business loan [ … ]

Category: Chart Of The Day

(Just Charts)

Japan’s Wild Market Ride & The Future of Monetary Policy

In case you haven’t been paying attention, the Japanese stock market is on an epic run. The Nikkei 225 is up 60% since last November when government officials began hinting [ … ]

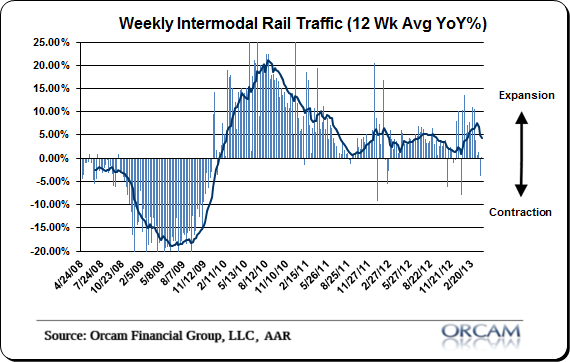

Rail Traffic Continues to Trend Lower

Recent rail trends have weakened substantially from very strong levels earlier this year. The latest weekly reading came in at 3.3% year over year, but continues a trend of low [ … ]

Chart of the Day: Real Gold Prices

Here’s some perspective on the recent gold rally and decline. Via Goldman Sachs: The 2012 average gold price was only 2.5% lower than the 1980 average of $1,711/ounce in real [ … ]

Most Overbought & Oversold Assets

Just a little big picture perspective for you here. This is the latest view of some of the biggest global asset classes and how oversold or overbought they are. I [ … ]

Inflation Update – Benign, but on the Rise?

This morning’s CPI report didn’t provide a whole lot of clarity on the direction of future inflation. The headline figure came in at 1.5% year over year while the core [ … ]

Commodities – They Have (Almost) No Place in Your Financial Portfolio

One of the things I really hate about the current Wall Street environment is how so many people have been fooled into thinking that commodities are a necessary part of [ … ]

Rail Traffic Trends are Starting to Slow

The latest rail data from the AAR showed another weak year over year reading at just 0.2%. This brings the 12 week moving average down to 5.25% from a recent high of 6.75% and is likely to slow substantially from here. Looking at the recent data and current trend it would not be surprising to see ~3% readings in this data by the time May rolls around.

Chart of the Day: Corporate Profits vs the S&P 500

I’ve made a big fuss over QE in recent years and yet the market continues to plough higher. I often have people ask me: “Why does QE make stock prices go higher if there’s no fundamental impact?” My answer is always the same.