Interesting commentary from David Rosenberg here regarding negative real rates and the tendency for excess to occur. I’d say this time is slightly different in that the low real rates [ … ]

Category: Chart Of The Day

(Just Charts)

The Waning Effect of QE?

Here’s an interesting point via SocGen that I haven’t seen many people discuss. Notice in the chart below how commodities have stopped responding to the QE effect while equities have [ … ]

A Good Start Tends to Mean a Good Year

91%, eh? Those are odds you can work with….Here are some general market thoughts via Credit Suisse on what happens when the year gets off to a good start. Unfortunately, [ … ]

Rail Traffic Continues to Show Expansion

Rail traffic is just one of many real-time indicators providing us with a clear picture of the NON-RECESSIONARY United States economy. This week’s data showed a solid 4% increase in [ … ]

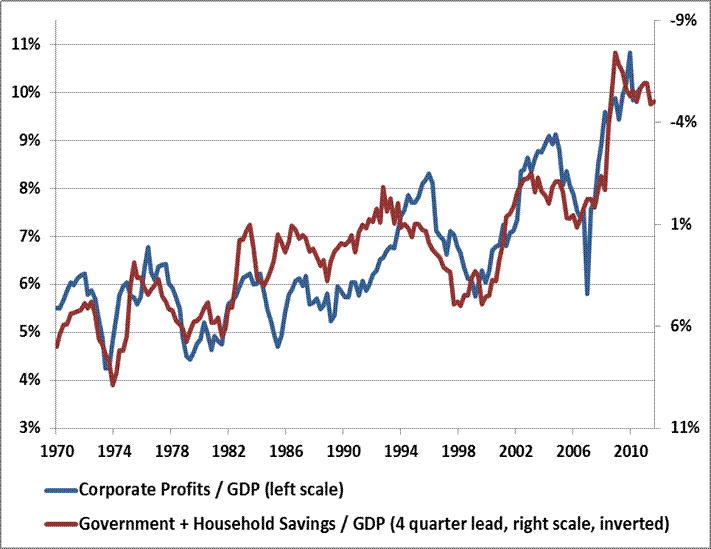

Profit Margins and the Government’s Deficit

Pretty interesting commentary here from John Hussman’s weekly letter in which he points out that one sector’s deficit is obviously another sector’s surplus. In the case of the government’s deficits, [ … ]

Rail Traffic Continues to Point to Economic Strength

No downturn in Warren Buffett’s favorite economic indicator….Rail traffic has now reached its highest 12 week moving average since 2011. With a weekly intermodal reading of 10.5% year over year the 12 week moving average is now at 6.75%. Here’s more via AAR:

Recession Index Still Says “No Recession”

One of the main indicators I rely on for the cyclical view of the markets is the Orcam Recession Index (which I update in the research regularly). It’s helped [ … ]

The Most Worrisome Charts

Business Insider has compiled a solid list of worrisome charts from many good Wall Street thinkers. I happened to be included although they titled the post “Wall Street’s Brightest Minds [ … ]

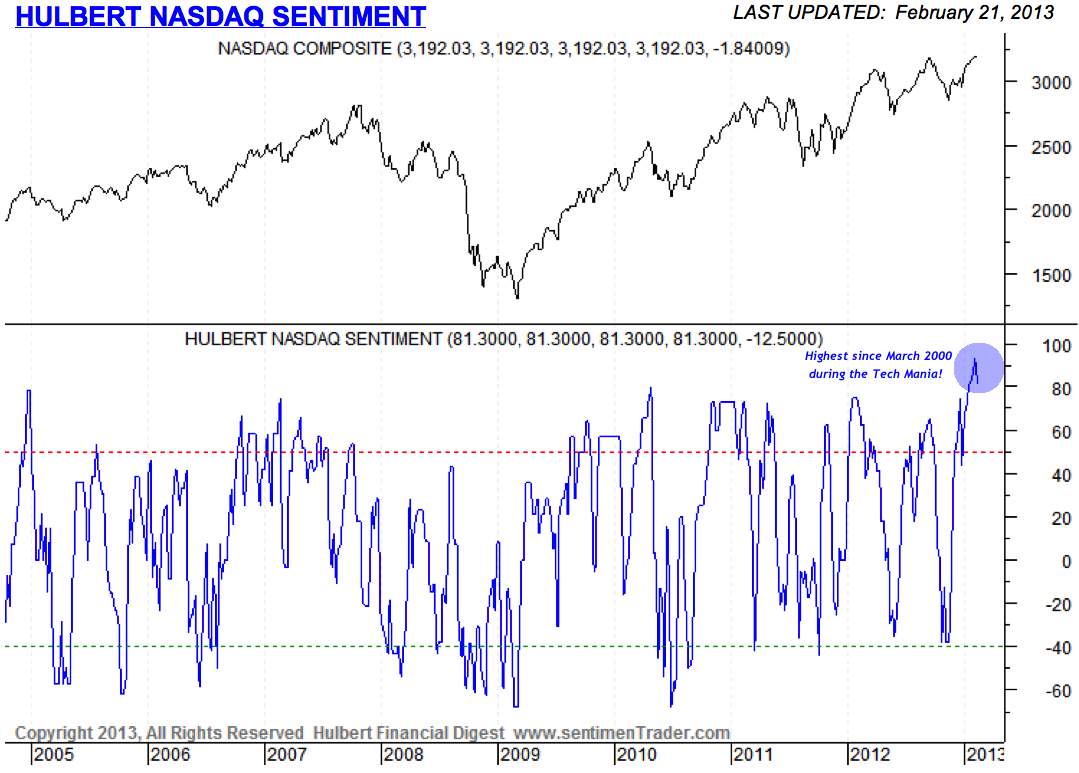

Nasdaq Sentiment Remains Near its Highest Levels Since March 2000

You might have thought that Monday’s slide in the equity market wiped out quite a bit of the euphoria in the markets. If so, you’d be wrong based on the [ … ]