Interesting commentary here via Business Insider and Jeffrey Kleintop of LPL Financial with regards to the recent surge in gasoline prices and how that might influence the economy going forward:

Category: Chart Of The Day

(Just Charts)

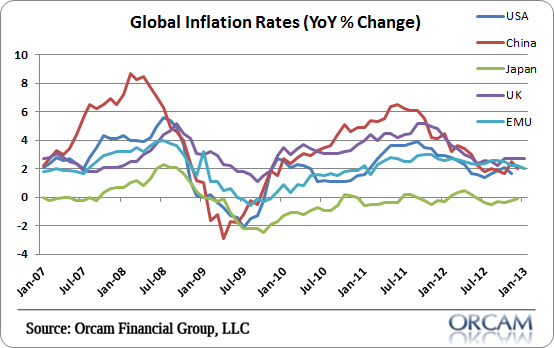

Visualizing Global Inflation Rates

Here’s a follow-up on yesterday’s US CPI release. The following chart shows the year over year changes in global inflation. I’ve included most of the major economies including the USA, China, Japan, UK, and EMU.

Your Housing “Recovery” in Charts….

I’ve become much more constructive about housing in the last year. But I still don’t understand the euphoria in some circles. For the most part, I am still in the [ … ]

Probability of Recession Remains Low

It’s not just the Orcam Recession Index that is pointing to low odds of a recession (and has been for years). Barry Ritholtz posted this from Bloomberg Briefs last [ … ]

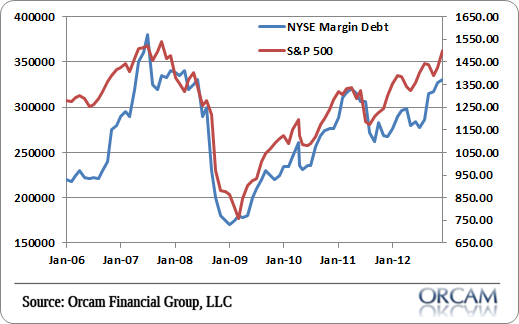

NYSE Margin Debt Stalks All-Time Highs

Here’s an interesting bit of correlation (and causation?) for you. Have a look at the chart I formulated below showing NYSE Margin Debt and the S&P 500. The two data [ … ]

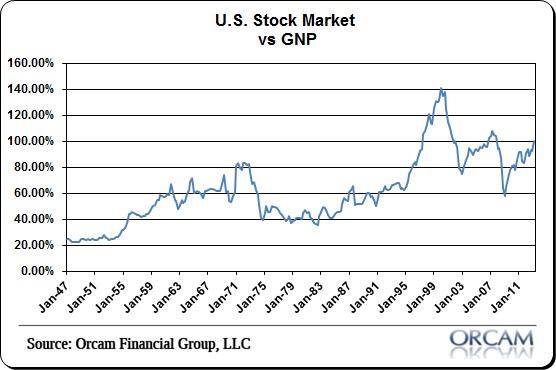

Buffett’s Favorite Valuation Metric Surges Over the 100% Level

For the first time since the recovery began, Warren Buffett’s favorite valuation metric has breached the 100% level. That, of course, is the Wilshire 5,000 total market cap index relative [ … ]

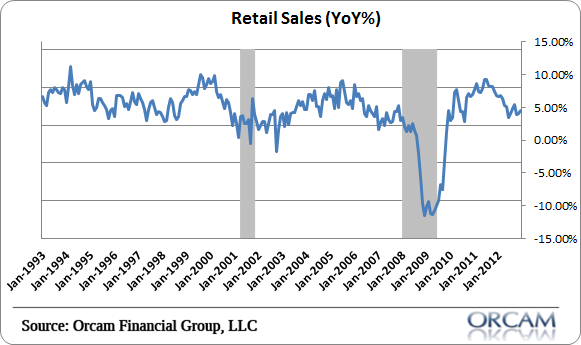

Retail Sales – Good Enough

This morning’s retail sales report showed some small signs of deterioration, but still pointed to a positive overall level of demand in the economy. According to the Census Bureau retail [ … ]

Stock and Bond Drawdowns – Historical Perspective

I thought this was a nice bit of perspective from CitiGroup analysts regarding the historical drawdowns between stocks and bonds. Proper portfolio contruction is all about understanding how different asset classes operate relative to one another. And while the past doesn’t perfectly rhyme with the future, it does provide us with a better general understanding:

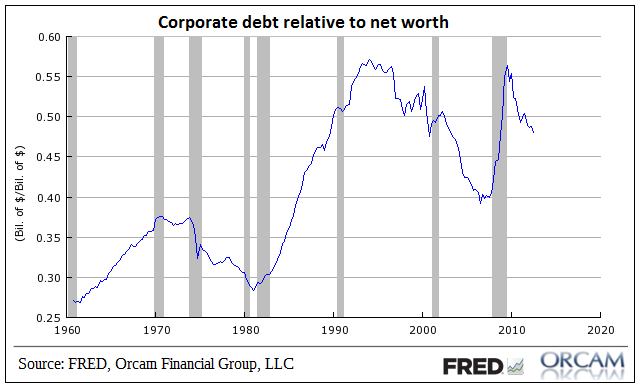

An Alternative View on the Corporate “Cash Hoard”

There’s been a lot of chatter in recent days (see Paul Krugman for instance) about the corporate cash hoard and how the economy would be humming if corporations were putting [ … ]