The beginning of the year is notoriously volatile in rail data, but a trend is developing and it’s a positive one. This week’s rail data points to another solid week [ … ]

Category: Chart Of The Day

(Just Charts)

SocGen: Economic Data & S&P Divergence Creates Downside Risk

Divergences, complacency, Fed easing, moderate economic expansion, single digit earnings growth, etc, etc. I don’t know what it all adds up to, but SocGen says the recent spate of weak economic data combined with the divergence in stock prices means downside risks are elevated:

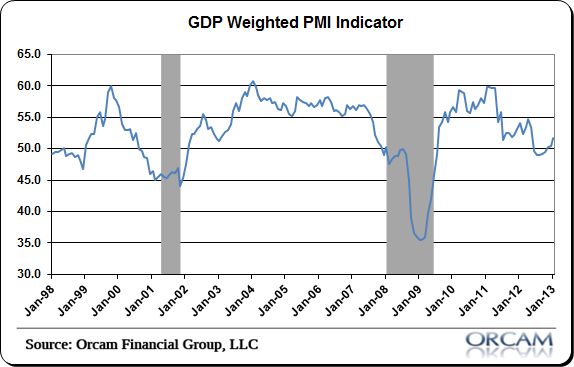

Globally Weighted PMI Improves in January

With all the global PMI reports in the books we can better gauge the health of the global economy. The January data was overwhelmingly positive. The January globally weighted PMI [ … ]

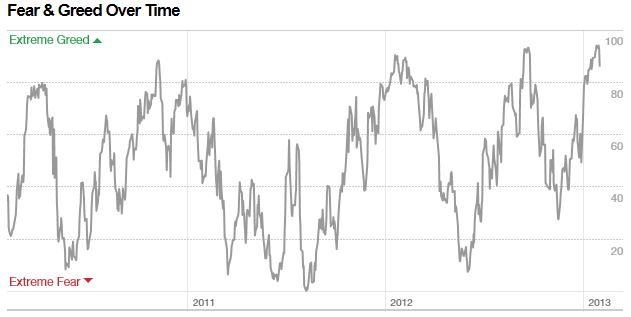

Fear & Greed Index Showing Signs of Extreme Greed

Interesting new indicator here from CNN Money that attempts to track the level of fear and greed in the market. They calculate the index using 7 indicators: Investors are driven [ … ]

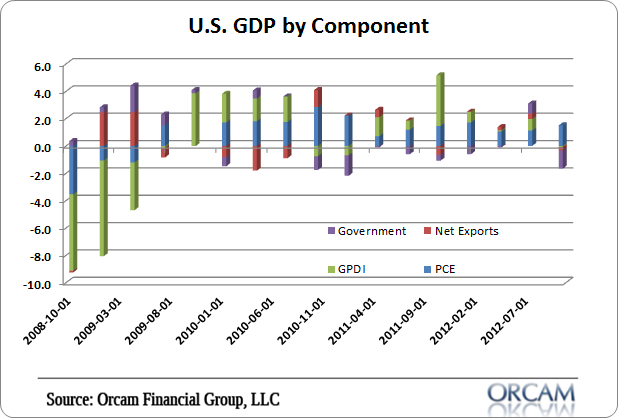

GDP Declines -0.1% in Q4

I am kind of out of the loop here due to travel so my apologies on such a brief post. As you likely know by now, Q4 GDP fell by -0.1%. A [ … ]

We’re all Active Investors

This is a good piece by Rick Ferri on the myth of passive investing. In essence, he notes that we’re all active investors. It’s just that some of us are less [ … ]

Durable Goods Confirm Strong PMI Readings in USA

Another strong reading in durable goods orders this morning. This is important for two reasons:

About that Global Secular Bear Market

There was a bit of pushback in my recent article regarding the end of the recession in the USA. I’ve been very vocal about the fact that the likelihood of [ … ]

Rail Traffic Starting to Show Signs of Weakness

The trend in rail traffic has moderated substantially in the last few months as the 12 week moving average in intermodal traffic hit its lowest reading since 2011. The current [ … ]