Just a brief indicator update here. The December Eurocoin index came in at -0.2 compared to -0.29 in November. That reading is still consistent with a contracting economy though marginally [ … ]

Category: Chart Of The Day

(Just Charts)

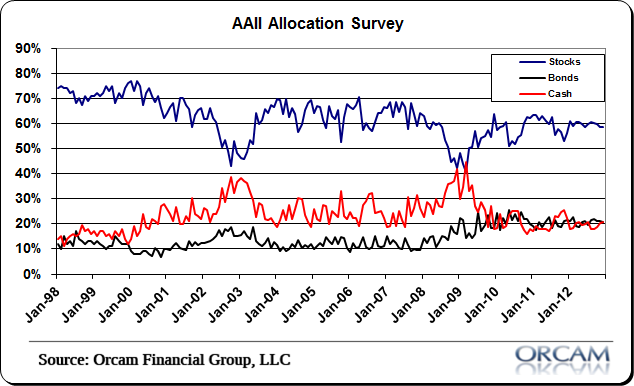

Small Investors Move Out of Stocks Ahead of Fiscal Cliff

Nothing earth shattering in this month’s AAII allocation report, but there was a small downside shift in equity allocation. We’re still well below the highest levels seen in the last [ … ]

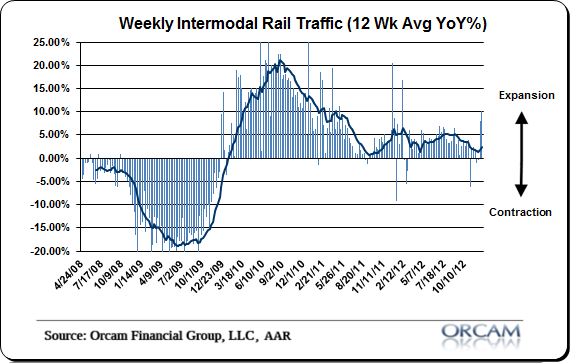

Rail Traffic Declines to Start 2013

The first reading on rail traffic showed a modest decline to -0.1%. The beginning of the year is usually a volatile period for rail traffic trends so it’s better to [ … ]

The Long View on Asset Class Returns

Here’s a good look at the 30,000 foot view of three major asset classes – gold, t-bonds and stocks. The following is the rolling 10 year average total returns since [ … ]

Globally GDP Weighted PMI Climbs in December

The final PMI readings for December are in and it points to a modest improvement in global economic conditions. Notable improvements came from the USA which registered at 54, India [ … ]

Wishful Thinking

Here’s an interesting graphic from the Wall Street Journal. It shows the Fed’s economic forecasts compared to the actual economic outcome. As you can see the Fed overestimated their forecast [ … ]

Rail Traffic Is Finishing 2012 With a Boom

Rail traffic is finishing 2012 in a big way. This week’s rail traffic data marks the second consecutive week of big gains with a 10.2% reading in year over year [ … ]

The Migration Out of Mutual Funds is Just Beginning….

Sober Look posted a good story yesterday on the outflows from mutual funds (see details below). This is one of the tidal wave trend changes in the investment business. [ … ]

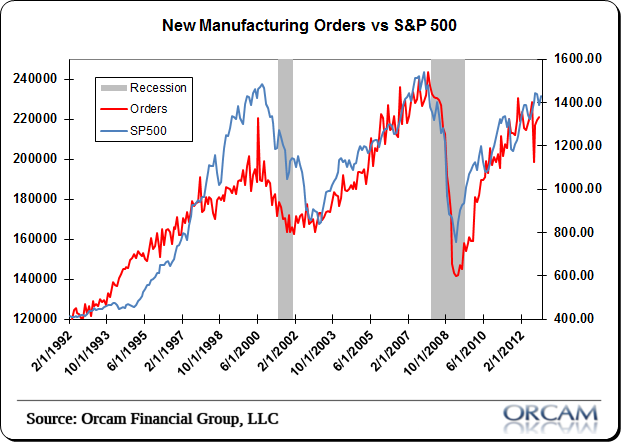

Chart of the Day: S&P vs Durable Goods

Durable goods tend to have a very strong correlation with the S&P 500. It’s far from an exact science, but tracking the directional trend in orders has tended to [ … ]