There’s a lot to be pessimistic about with all the downside risks in the macroeconomy. Europe is teetering on the edge, the fiscal cliff is all anyone can talk about [ … ]

Category: Chart Of The Day

(Just Charts)

Chart of the Day: Earnings Revisions and Stock Prices

With all the macro currents it’s difficult to remember that profits are ultimately the primary driver of stock prices. This chart via Bloomberg and our friend Martin at Macronomics shows the very close correlation between the changes in earnings expectations and stock prices:

Zillow: House Prices Continue to Rise

Is this a turning point or a dead cat bounce? I’d say it’s signs of positive improvement and I am infinitely more bullish on housing than I was over the [ … ]

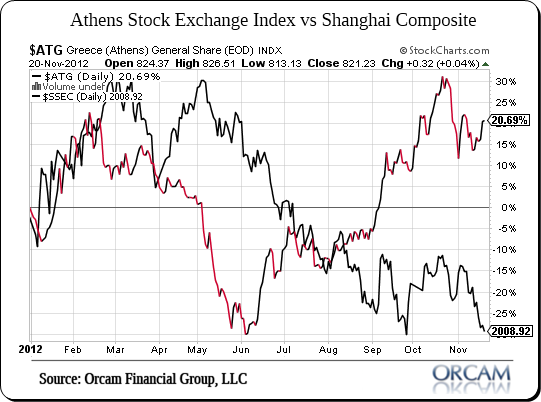

When Depressionary Economies Outperform Expansionary Economies…

Say whatever you like about Greece, at least their stock market is performing better than…China’s.

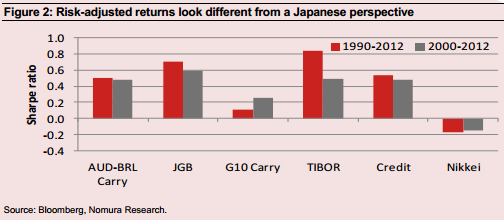

Fixed Income Asset Classes Outperform During a Balance Sheet Recession

The implications of the balance sheet recession go well beyond public policy mistakes. As we’ve seen over the last few years, misunderstanding the disease has also resulted in massive portfolio [ … ]

Chart of the Day: Apple vs Microsoft

I jumped off the Apple bandwagon about a year ago when I bought my first Android (which was admittedly just an adequate phone) and started to get the impression that [ … ]

Chart of the day: European PMI & Recession

Here’s a good update on the situation in Europe showing Eurozone PMI’s and GDP Growth. The latest services reading came in at 46 while the latest manufacturing PMI came in [ … ]

A Sitting Democratic Presidential Win – Bad Market Omen?

A lot of investors put enormous emphasis on seasonal trends and the Presidential cycle. I can’t say that I do, but it’s always an interesting study in historical market trends. [ … ]

Bank of America: The Most Under Appreciated Risk

Business Insider ran a good piece yesterday discussing the most under appreciated risk in the markets as highlighted by Bank of America analysts. They said: “The one risk that appears [ … ]