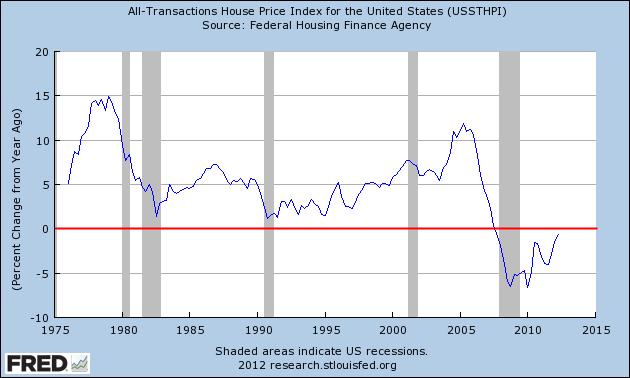

One thing I keep reading all over the place is this myth that a recession won’t happen because residential real estate is appreciating. Of course, the implication is that rising [ … ]

Category: Chart Of The Day

(Just Charts)

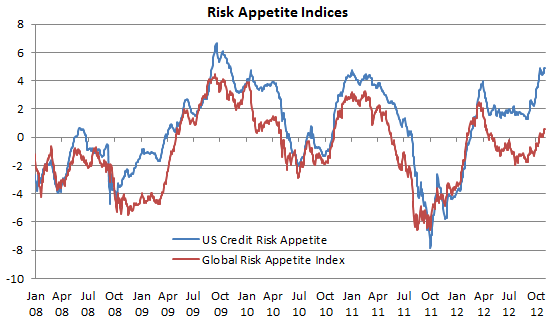

Chart of the Day: Risk Appetites Surge

Here’s a good update on risk appetite via Sober Look who brings us the Credit Suisse Risk Appetite Index. The divergence between credit and equity risk appetite in recent years [ … ]

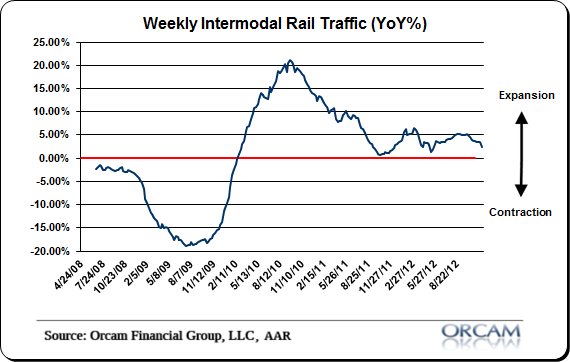

Rail Traffic Takes a Turn for the Worse

Rail traffic turned down sharply this week as intermodal traffic dipped -6.2%. That brings the 3 month moving average to 2.7%, down sharply from last week’s reading of 3.5%. One [ … ]

Hedge Funds: What Have you Done for me Lately?

Here’s an interesting chart of the day for you. It shows the total returns of the HFRX Global Hedge Fund Index versus the Vanguard Total World ETF. The results [ … ]

USA Recession Odds: 100%?

Here’s an interesting new data point that the St Louis Fed has put together to calculate recession probabilities: “Recession probabilities for the United States are obtained from a dynamic-factor markov-switching [ … ]

Why The Stock Market is Rooting for Obama

I’m going to do something I don’t generally like to do here and delve into the realm of the political. Not because I want to, but because I think this [ … ]

Gold’s Divergence From Major Commodities

I’ve attached some interesting thoughts sent to us via Societe Generale on the price divergence in gold and other major global commodities. Gold continues to behave as a hedge against [ … ]

When the Hedge Fund Industry Evolves…in a Bad Way

That headline probably has you wondering – is there a way hedge funds can evolve in a good way? Of course there is. But this story is troubling recent [ … ]

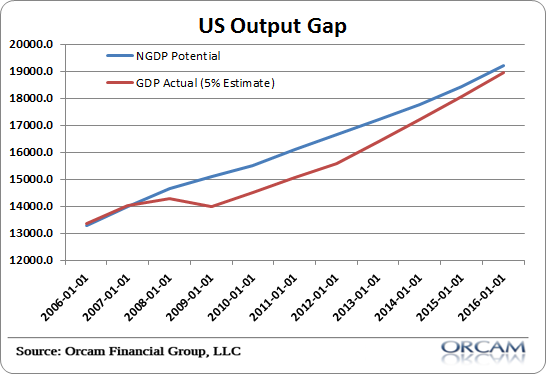

The US Economy Needs a Minor Miracle to Get Back to “Normal”

If we take a look at the output gap in the USA we can obtain a far better understanding of the hole that the Great Recession put us in. Here [ … ]