Here’s a good chart (figure 1) via Martin at Macronomics that expands on the divergence between the US and European economies. Although the US economy is not exactly growing strongly, it is [ … ]

Category: Chart Of The Day

(Just Charts)

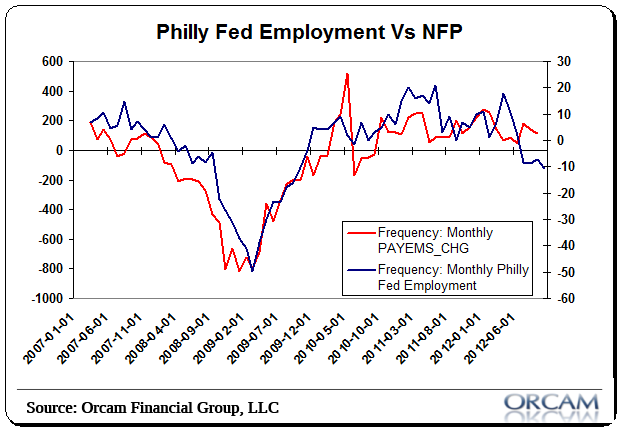

Philly Fed: Diverging from Payrolls?

This morning’s Philly Fed survey printed another terrible employment figure. History, non-farm payrolls and the Philly Fed data tend to track eachother pretty closely. The latest figure of -10.7 on [ … ]

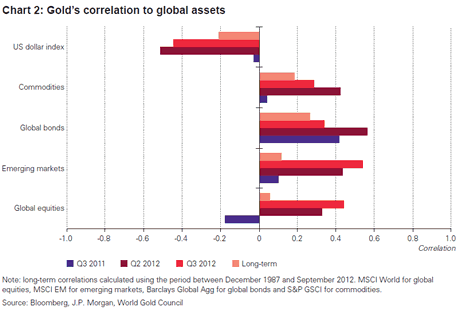

Gold’s Correlation to Global Assets

Just posting this here more for reference than anything else as it’s always important to keep track of correlations for portfolio construction….(via the World Gold Council): Correlation statistics between gold [ … ]

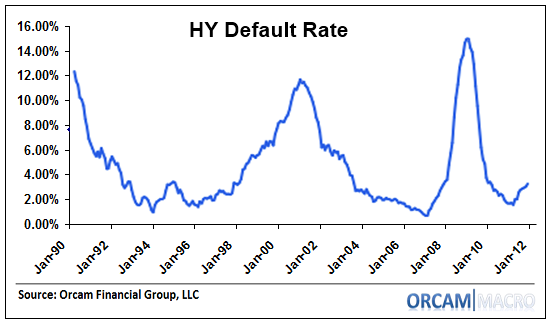

A Few Cracks in the Fundamentals…

Here’s an interesting downgrade from Morgan Stanley that carries some macro relevance. They’ve downgraded their view on high yield credit due to some “cracks in the fundamentals”. They’re not sounding [ … ]

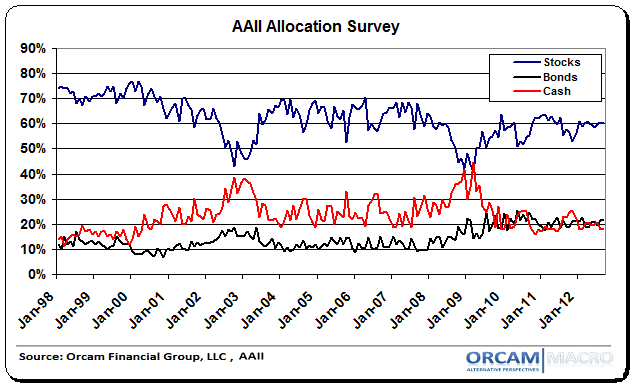

AAII: Fixed Income Allocations Rise to 7 Month High

The latest monthly allocation reading from the AAII showed a continued jump in bond allocations as small investors continue to look for safe income. Although the continual Quantitative Easing policies [ … ]

Could Rates be at Zero Until 2016?

The Wall Street Journal reported on an important speech from Minneapolis Fed President Narayana Kocherlakota. He said rates should stay low until unemployment is at 5.5%: “NEW YORK–A Federal Reserve official [ … ]

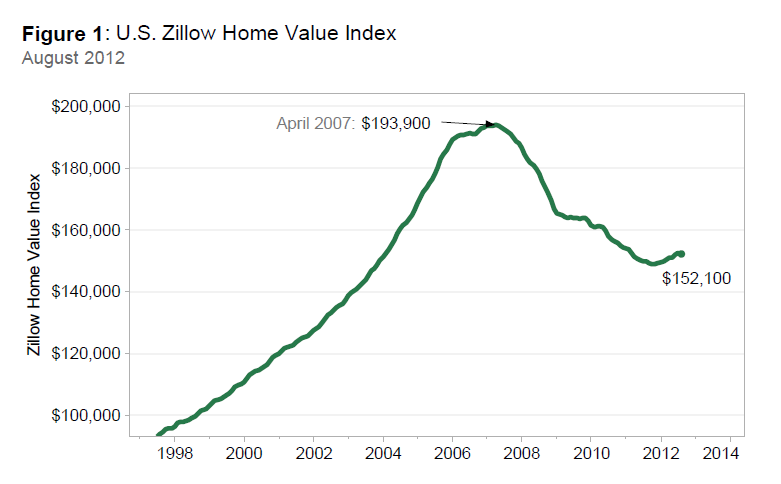

Zillow: Home Prices Stagnate After 9 Months of Appreciation

Zillow is reporting a slowdown in recent house price appreciation after 9 months of gains. The decline was marginal, but consistent with a slow seasonal period and still difficult real [ … ]

Random Indicators from the Non-Recession File….

I’ve provided quite a few random recessionary indicators in recent weeks (see here and here) so I figured I might return the favor for the bulls out there and offer [ … ]

Zillow: Home Prices Continue to Climb

Do we indeed have a little housing recovery in the making? This would certainly bolster the no recession calls, but I am not getting overly optimistic. I still think we’re [ … ]