I feel bad because I saw this on Twitter in the last hour and now can’t find where I got it from (if you know the source please let me [ … ]

Category: Chart Of The Day

(Just Charts)

The Best of Times & the Worst of Times

Nice graphic here from Meb Faber on the best and worst investing times. I’m not a big value guy, but do you notice the trend: “Many of the best year [ … ]

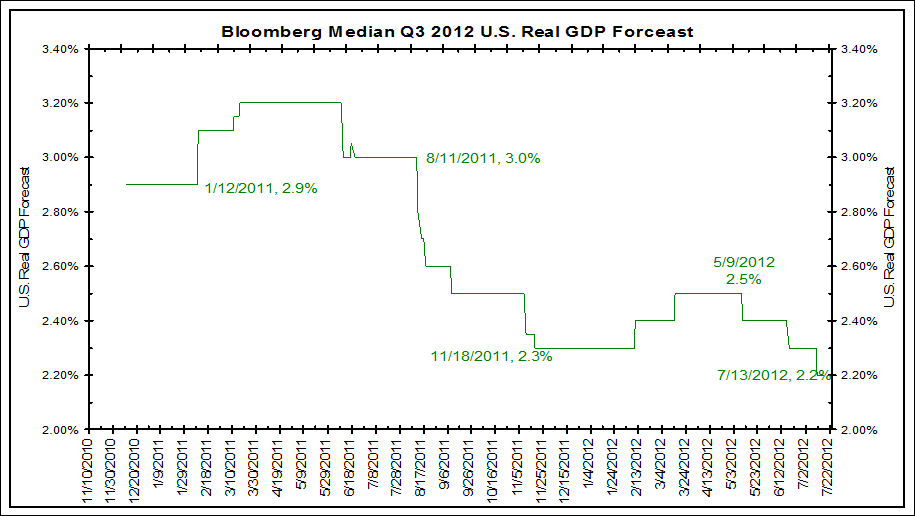

Those Collapsing GDP Forecasts

James Bianco has a good set of charts over at Ritholtz’s site showing the decline in GDP forecasts over the last few quarters. It shows how optimistic and how wrong [ … ]

Updated Sectoral Balances

I am a little late to the party here following the Fed’s Z1 release, but here’s an update on the current state of the sector balances in the USA. For [ … ]

Commodities Make the QE2 Round-Trip

Remember all those calls for hyperinflation following QE2 and how all that “money printing” was going to wreak havoc on global prices? Well, prices have sure been wrecked, but in [ … ]

BUFFETT’S FAVORITE VALUATION METRIC SAYS….

Stocks are moderately expensive….

THE “TRANSITORY” INFLATION….BERNANKE WAS RIGHT

I don’t often give Ben Bernanke a lot of credit for the job he’s done. I am admittedly hard on him and perhaps unfairly so. But he deserves some serious [ … ]

EUROPE’S CONTAGION INTO CHINA….

Much has been made in recent weeks about the Eurozone troubles and the spillover into China. It’s nice to put things into context in order to understand the global effect [ … ]

USA – STILL DECOUPLING FROM EUROPE?

Last year I made a very unpopular call that the US economy was likely to remain in positive growth territory as Europe sank into recession. In an increasingly interconnected world [ … ]