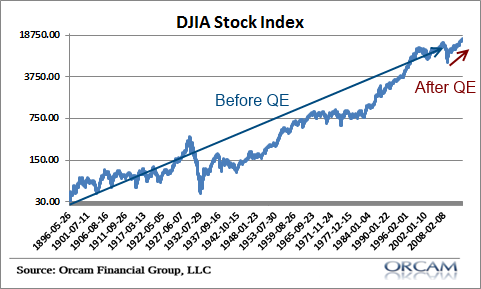

Every time the market takes a tumble these days everyone seems to blame the “taper” or QE. I guess there’s always a need to apply a cause to every market gyration. But I wanted to bring some perspective back to this conversation …

Category: Chart Of The Day

(Just Charts)

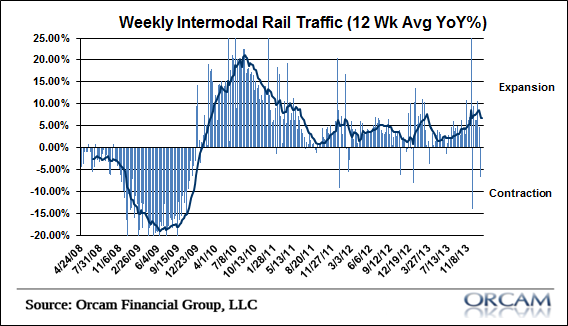

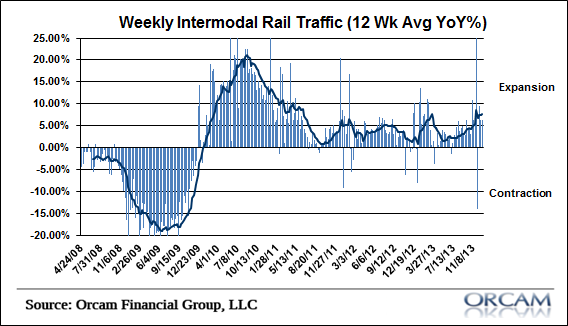

Rail Traffic Slips

Rail traffic fell in the second week of the year with intermodal recording a -6.7% reading. This was the worst reading since early December. This brought the 12 week moving average to 6.77%.

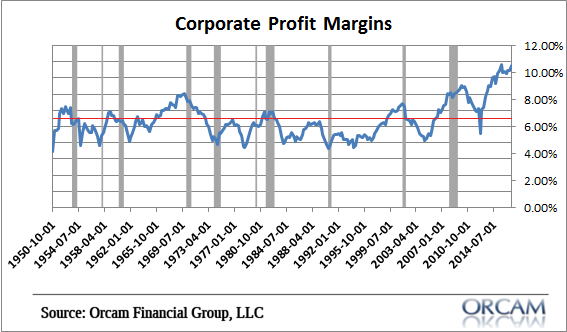

When Will Corporate Profit Margins Contract?

There are few signs of impending doom that are more widely cited than record high profit margins and the inevitable mean reversion that always comes following such an environment. It’s true. As you can see in the chart below profit margins have averaged about 6.5% over the last 65 years and every time they’ve gotten well above that 6.5% range they’ve come back to earth.

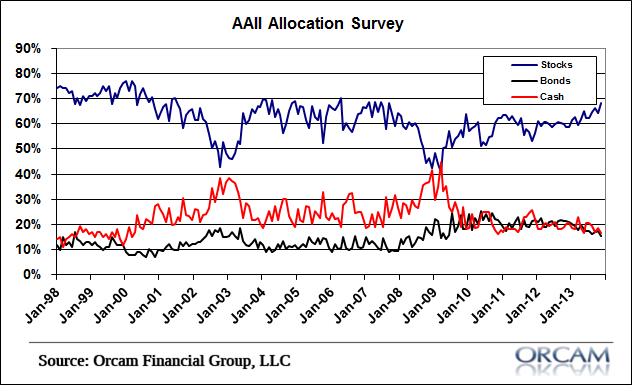

Individual Investor Stock Allocation Hits Post-Crisis High

The latest asset allocation survey from AAII showed a new high in demand for stocks and new lows for both cash and bonds. Stocks experienced a notable jump to a 68% allocation from just 64% in November. Bond holdings were down 2% to just 15% and cash holdings were down 2% to 16.5%.

Rail Traffic Ends 2013 at a 2.5 Year High

Rail traffic finished 2013 with a boom. Intermodal jumped 10.6% on the week which brought the 12 week moving average to 7.6%. That is the highest 12 week average reading since May of 2011.

CBOE SKEW Index Spikes to Bearish Levels

Throw this one in the “signs of frothiness” bin. The CBOE’s SKEW Index attempts to measure the potential for an outlier event. Readings at current levels are extremely unusual and [ … ]

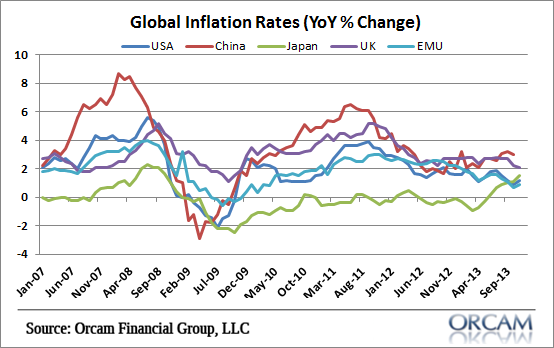

Chart of the Day: Global Inflation Remains Extremely Low

The latest global inflation readings from November all showed continued low rates of inflation. Each of the major economic regions of the world showed continued low rates of inflation:

Bullish Sentiment Surges as Optimism Spreads

The most hated bull market in history is slowly but surely turning into one built on perennial optimism. If there was one major insight from 2013 it was that the [ … ]

Rail Traffic Continues to Show Positive Economic Signs

Rail traffic continues to post strong numbers as the year comes to a close. Through 51 weeks intermodal traffic has posted a 4.5% year over year growth rate – not far from Q3 GDP of 4.1%. The weekly reading of 6.4% brings the 12 week moving average to 7.2% which is just shy of a 9 month high.