The last 10 years have exposed a very important reality for any global asset allocator – US Treasury Bonds are the ultimate safe haven investment. For decades we have heard [ … ]

Category: How Things Work

There’s Nothing “Natural” About the Economy and the Financial Markets

At the most basic level, the entire economy and financial system is highly unnatural. It is entirely made up out of thin air. Stocks, bonds, cash, money – all of [ … ]

The Importance of First Principle Thinking

I loved this interview with Elon Musk discussing a wide range of topics. Of particular interest were his comments on first principle thinking. First principle thinking is the formation of [ … ]

What If Everyone Indexed?

I see this question more and more as indexing grows in popularity. People generally think that more indexing will make the markets function less efficiently . I don’t think this [ … ]

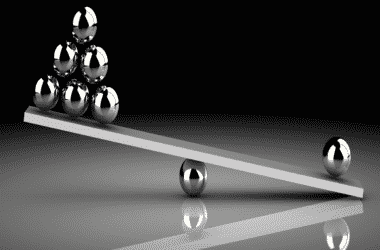

What is Portfolio “Risk”?

The idea of risk is a rather confusing and nebulous concept in modern finance. The traditional textbook definition of “risk” is standard deviation or volatility. This is convenient for academic purposes because [ … ]

What is Countercyclical Indexing?

We founded the concept of Countercyclical Indexing by answering some simple questions: Is a “balanced index” like a 60/40 stock/bond portfolio actually balanced? Does it make sense to rebalance back [ … ]

Problems with the Short-Term

Earlier this year I spoke about the problem of “the long-term”. This is the tendency for modern finance to emphasize a long-term view due to the fact that assets tend [ … ]

Understanding the Modern Monetary System – Newly Updated Version

About once every 18 months I try to update my paper ” Understanding the Modern Monetary System” to account for important new understandings and potential evolutions in the monetary system. [ … ]

Where Does Money Come From?

“The process by which money is created is so simple the mind is repelled.” – JK Galbraith There’s a reason why myth # 1 in my “biggest myths in economics” is [ … ]