If I had to pick the single largest problem in the investment community it would be irrational expectations about future returns. This comes from several sources. The primary one being [ … ]

Category: Investing Basics

Beat the Average Investor by not Trying to “Beat the Market”

If we look at “the market” of financial assets from the 30,000 foot perspective then an obvious reality becomes clear – there is actually ONE portfolio of all outstanding financial [ … ]

Investing and the Intertemporal Conundrum

I went to see Interstellar last night. I won’t ruin it for you, but if you’re in to things like time travel, intergalactic travel and space ships then you should [ … ]

Great Investors Think in Terms of Probabilities

The smartest investors know that they’re actually not that smart. That is, they recognize the fact that they’re going to be wrong a lot. But in realizing this they also [ … ]

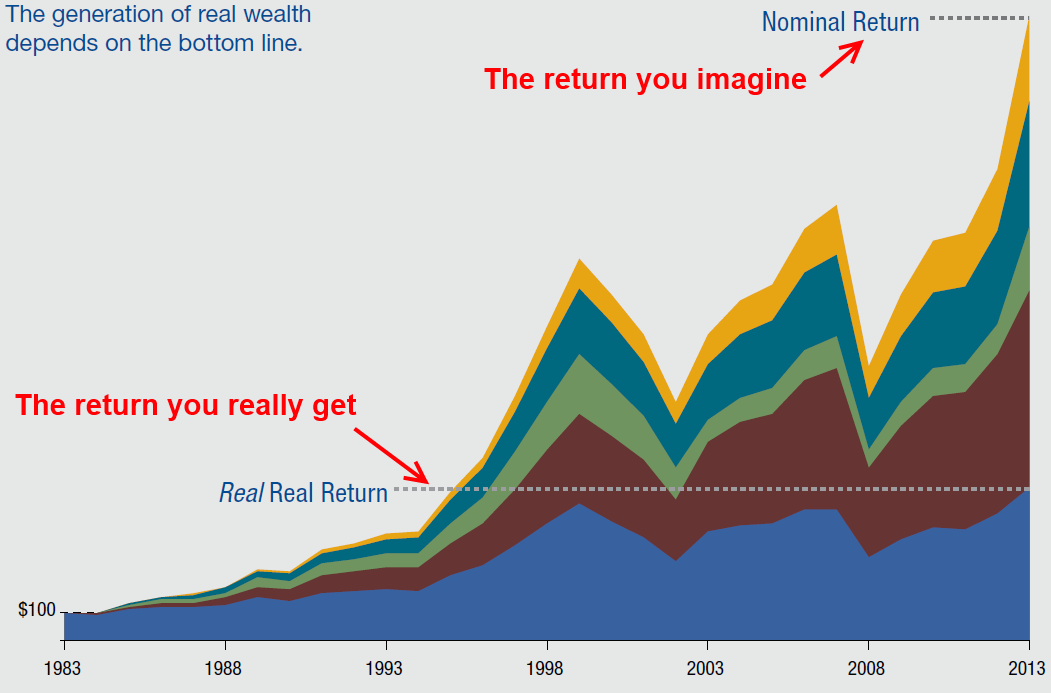

Understanding Your Real, Real Returns – Fee Edition

A recent post of mine discussed the importance of understanding your real, real returns (see here). That is your return after fees and inflation. We don’t usually hear about this [ … ]

Saving is not the Key to Financial Success

You’ve probably heard it a million times from financial “experts” – the key to financial success is saving. The idea is that if we save more now then we’ll have more [ … ]

Understanding Your Real, Real Returns

Thornburg Funds has a new report out on understanding your real, real returns and it’s fantastic. I discuss this topic in detail in my book, but they do a much better job covering [ … ]

Should You Use an Automated Investment Service?

Is an automated investment service (AKA, a Robo-Advisor) like WealthFront or Betterment a good idea for your portfolio? Here are the pros and cons.

The Stock Market isn’t Where you Get Rich

You’re much more likely to become wealthy investing in your own ability to generate future production than you are by buying an asset that was actually someone else’s investment.