Recent economic data has bond yields jumping a little bit on the worry of higher future inflation. According to many this is the main concern behind the recent volatility in [ … ]

Category: Most Recent Stories

Whodunit?

In the wake of a relatively meager 10% sell-off in the stock market we’re seeing the old financial “blame game” play out all over the place. Here’s an article blaming [ … ]

How to Overcome Your Fear of Bonds

I specialize in building relatively conservative “all weather” style indexing portfolios. They are designed for people who have a reasonably long time horizon (at least 5-10 years), don’t want to [ … ]

Make Investing Simple Again

Back in 2013 I wrote about how dangerous many of the new products on Wall Street are. I said this about XIV, an inverse volatility fund: But you have to [ … ]

Why the Stock Market Falls (Sometimes)

Whenever the stock market falls people always try to explain why. The honest answer is “no one knows”. We don’t really know why the stock market rises and falls on [ … ]

What Will Happen to Bonds if Interest Rates “Normalize”?

There’s a lot of chatter out there about rising interest rates and “normalizing” rates. As I’ve written about before, I think most of these fears are a case of short-termism [ … ]

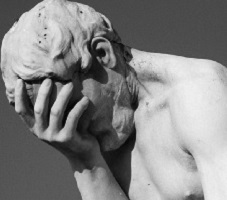

An “Oh Sh$T” Chart of the Day

One of the consistent themes on this blog over the last few years has been a Trump stock bubble. It’s pure speculation, but it makes a lot of sense when [ … ]

Do Bond Prices Have Momentum?

Here’s a strange thought from Jeff Gundlach, one of the world’s largest bond managers: “If you get above 3%, then it’s truly, truly game over for the ancient bond rally.” [ … ]

3 Things I Think I Think – Wrong!

This is definitely my favorite Donald Trump GIF: via GIPHY In keeping with that spirit, here are some things I think I am thinking about: 1. “The US economy is [ … ]