When you’re choosing an equity market allocation I generally prefer to keep things simple – just buy a low fee global market cap weighted portfolio and call it a day. [ … ]

Category: Most Recent Stories

2 Annoying Myths About Low Rates

There’s usually two forms of ideological rhetoric that accompany low interest rates. The first is that the Fed has “manipulated” interest rates lower. And the second is that the Fed is “punishing savers”. Let’s take a look at each of these ideas because I find them misleading at best and hypocritical at worst.

Will Centralized Entities Ruin the Decentralized Party?

One of the key aspects of the crypto boom that keeps bothering me is the inherent conflict between centralized entities and decentralized entities.¹ For instance, let’s think about Bitcoin. Bitcoin [ … ]

Please Millennials, No Do Not “Save” in Bitcoin

Alright Millennials, listen up – I am older than you and that means I am smarter than you so take a few minutes and soak up this old man’s knowledge [ … ]

Waiting for The Market to Boom is a Terrible Strategy

Sam Lee wrote a very awesome piece last year titled “Waiting for the Market to Crash is a Terrible Strategy“. The basic gist of the post was that you shouldn’t [ … ]

Let the Paramedics Sort Them Out

So, Bitcoin is soaring and very few people understand how this will all end and whether these cryptocurrencies will even be viable economic variables. We’re in that early part of [ … ]

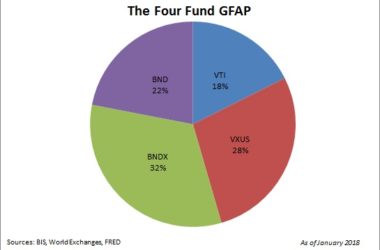

The 2018 Global Financial Asset Portfolio

The Global Financial Asset Portfolio¹ is a simple approximation of the world’s current financial asset allocation. It is, in my opinion, the logical starting point for anyone trying to build [ … ]

The Best of Pragcap in 2017

2017 was another year of learning and trying to spread that education to the readers here. I am so grateful for all the people who find the content here useful [ … ]

My Favorite Financial Content of 2017

2017 was another year of incredible content distribution across an ever growing number of platforms. Here is a list of just a few of the things I enjoyed most. If [ … ]