Here’s a good paper on the mutual fund industry from S&P. It shows more interesting evidence that the mutual fund world is, for the most part, a world of closet [ … ]

Category: Myth Busting

(Popular Myths of the Economy and Markets….BUSTED!

Why Didn’t QE Cause High Inflation?

Larry Kudlow has declared the deficit hawks (the inflationistas) the losers of the long raging inflation debate (see here for details). After almost 5 years of QE and thousands of [ … ]

The Fed’s Dual Mandate is Bull Sh*t

Pardon the title. But I didn’t know of a much more succinct way to say it without emphasizing the point. The thing is, I am tired of hearing about the [ … ]

Japanese Hyperinflation? Don’t Bet on it

Michael Casey from the Wall Street Journal wrote a provocative piece last week that laid out the case for hyperinflation in Japan. The argument essentially comes down to too much [ … ]

My Quick Take on Gold as an Investment, a Currency & Money

Question: I’ve read some of your stuff on gold, but can you give us a general opinion of the gold standard, gold as money and gold as an investment?

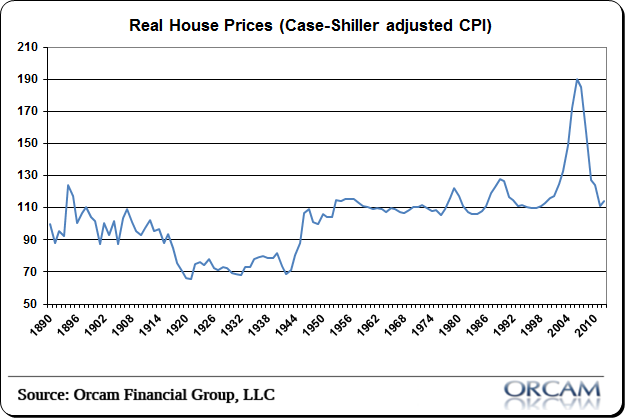

Is a House Really a Good “Investment”?

I’ve had this post queued up for three months debating whether to post it or not because I know it will ruffle a lot of feathers. Then I read this [ … ]

So Much for Non-correlation in Hedge Funds

Hedge funds are now allowed to advertise to the general public and boy are they going to need it. Recent data not only shows abysmal performance, but increasing mutual fund-like [ … ]

Market Volume is Rarely an Indicator of Anything

There’s been a lot of ink spilled in recent years over the “low volume rally” in the equity markets. In case you don’t know, volume on the NYSE has declined [ … ]

Putting the “Collapse” in Japanese Government Bonds in Perspective

It’s no secret that I am skeptical of the approach to stimulus via Abenomics. I think it’s potentially creating a very dangerous disequilibrium in markets like their stock market that [ … ]