Eric Cantor, the House Majority Leader, stirred up quite the controversy on Labor Day when he tweeted: “Today, we celebrate those who have taken a risk, worked hard, built a [ … ]

Category: Myth Busting

(Popular Myths of the Economy and Markets….BUSTED!

On Lowering Interest on Reserves….

There’s been a lot of chatter in recent months about the Fed potentially “stimulating the economy” through a reduction in the rate paid on reserves. The idea is generally related [ … ]

Housing, the Great Recession and Myth-Making

In a recent story, Matt Yglesias takes issue with the “myth-making” idea that the recession was essentially the same thing as the housing collapse. He says: “But the chart also [ … ]

Recency Bias and Investor Pitfalls…

I’ll make this brief. I hate the chart below. It shows a comparison of 2011 vs 2012. The implication is simple – since the market performed in a certain way [ … ]

The Anniversary of the S&P Downgrade – Have we Learned Anything?

It’s now been one year since Standard and Poors downgraded the debt of the USA from AAA to AA+. If you recall, many pundits were saying this would be an [ … ]

Yield Myths

Paul Krugman has a good post up about interest rates which I think requires a bit of elaboration. He says: “Low interest rates on the bonds of just about every [ … ]

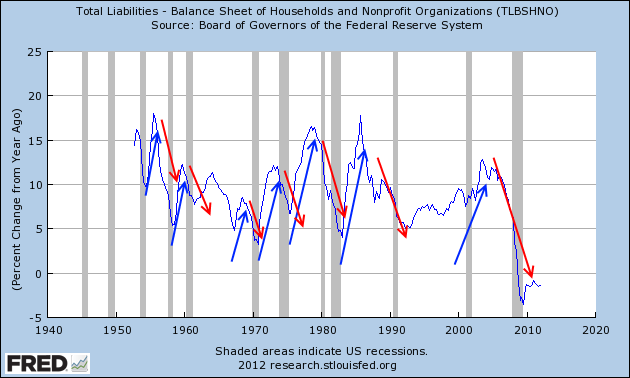

Failing to Connect the Boom to the Bust

Scott Sumner has a post up today that says “debt surges don’t cause recessions“. I think this is a lot like saying that eating a lot of food doesn’t [ … ]

The Most Common Misconception About the Economy…

James Galbraith was recently interviewed in the University of Texas Alumni magazine and offered an opinion on the “most common misconception about the economy” (via The Alcalde): “The Alcalde: What’s the [ … ]

Why the USA Isn’t Going Bankrupt….

Here’s a common question I get via email: “Can you explain why you don’t think the USA is going to have a Greek style debt crisis?” Good question! This is [ … ]