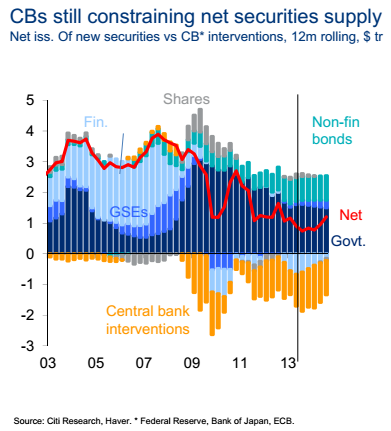

This is one of the more important charts out there today. One of the impacts of QE is that it reduces the amount of outstanding portfolio options for investors. When the Fed swaps deposits for T-bonds/MBS they force a portfolio rebalancing on the private sector. This creates a sort of hot potato effect in cash whereby cash holders will experience increased demand for other assets as the supply of safe interest earning options is reduced. You can see the dramatic impact of this portfolio rebalancing in the following chart from CitiBank:

Now, this cuts both ways potentially. In an environment where fundamentals are improving the reduced supply of less safe private sector assets pushes up demand for these assets. But what if we were to enter an environment where the fundamentals for these less safe assets declined? We could very well see a flight to safety which would cause the limited supply of lower risk assets to be in extremely high demand while the remaining supply of less safe assets might actually experience an abnormally low level of demand.

So the question is – will the fundamentals stay strong?

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.