I liked this post by Surly Trader which highlights an importance difference about stocks and bonds that often goes overlooked – that is, a bear market in bonds is a very different animal than a bear market in stocks. Given that there seems to be such widespread fear over bonds and rising interest rates, I think this is an important point (via ST):

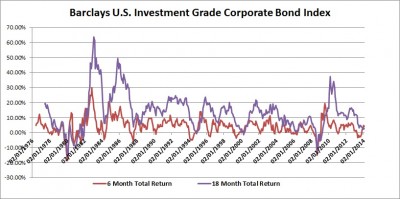

From the return side, let’s look at the bad days. If you look at the rolling total returns of the Investment Grade Corporate Bond Index since 1976, the bad 6 and 12 month total returns were shy of -20% in the early 80′s:

The funny thing about bonds is that their returns are “self-fixing”. The bonds move back to Par ($100 per face) price at maturity over time. In addition, the investor continues to re-invest his/her coupons at higher interest rates thereby dampening the changes in price of the underlying bond holdings.

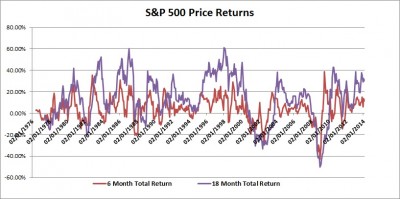

As a comparison we can look at S&P 500 price returns over the same time period. Total returns are not available back to 1976, but they would be very close to the rolling price returns:

He notes:

“Stocks fix themselves as well, but the drawdowns are more frequent and returns are obviously more volatile”

That’s the key point. Stocks and bonds are very different types of instruments which serve very different roles in a portfolio. Comparing them or thinking about “bear markets” or “bubbles” is often done in such a manner that implies an unjust level of fear with regards to how those environments might apply to these very different instruments. Don’t let a bond bear scare you into thinking that a bear market in bonds is anything remotely similar to a bear market in stocks….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.