One of the most important things you learn when you start to think of the world in a macro way is that you start looking at both sides of the ledger before making sweeping conclusions. This helps you to avoid falling victim to a fallacy of composition. In other words, you stop extrapolating micro experiences out into the macro with the assumption that what’s true for one person or component is representative of the entirety. That’s completely false in many cases although it’s easy to relate to or digest.

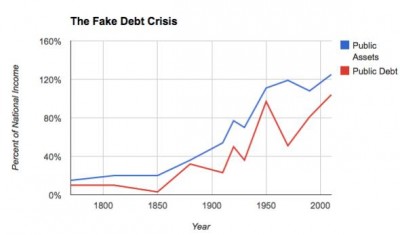

So I really like this chart from Matt Yglesias who takes it from Thomas Piketty’s new book Capital in the Twenty-First Century which shows the USA’s “debt crisis” in the proper perspective:

This is similar to a point I made a few months back about how the US government is not in the debt hole that many present it to be in. You have to look at both sides of the ledger as Matt points out. Looking at one side gives you a totally misguided perspective of the entire picture. And in the case of the USA, well, we’re doing much better than most people think.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.