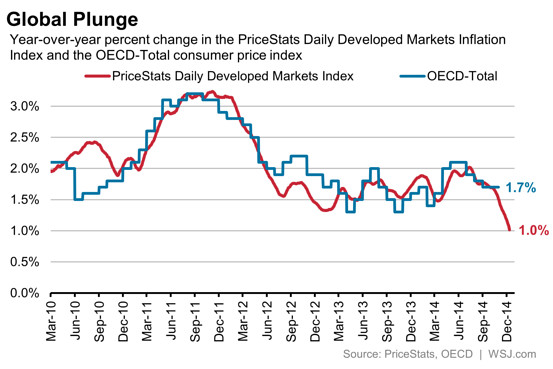

I mentioned earlier this week that the inflation threat is totally off the table in the near-term thanks to the collapse in oil prices. And we now have a great idea of just how much the decline in oil prices is impacting prices. The PriceStats Daily Developed Markets Index follows prices in the USA, Canada, Japan, Australia, the United Kingdom and Europe. And it’s telling us a very grim story (via Josh Zumbrun at WSJ):

My guess is we’ll see a snap back at some point in late 2015 as the year over year comps become very low, but for the near-term there is very clearly no threat of inflation. And that means that any Fed tightening is going to be put on the back burner.

Update:

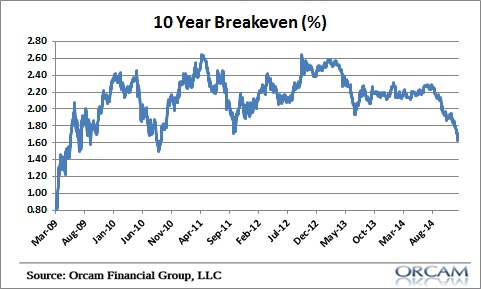

Here’s another view of this that might be helpful in terms of putting this in some historical perspective. The 10 year break-even rate which shows inflation expectations has now declined to levels that we haven’t seen since 2010:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.