Here’s some nice perspective on the market cycle from Lance Roberts:

An interesting article this morning via Investment News caught my attention:

“After watching the stock market climb from peak to peak last year, investors are finally starting to warm up to equities.

More than 85% of investors are feeling optimistic about the investment landscape, and 74% think stocks have the greatest potential of any major asset class, according to a survey of 500 affluent investors released Monday by Legg Mason Global Asset Management. The survey was conducted in December and January.

The survey also shows that investors still hold relatively conservative portfolios, but are increasingly willing to increase exposure to international assets.”

This is not a surprising survey by any measure. In fact, it is typical of what you would expect from a group of individuals whose investment decisions are primarily driven emotional behavior rather than a disciplined investment process.

“At the time this survey was conducted, investors had experienced in the U.S. a pretty positive stock market,” said Matthew Schiffman, managing director and head of global marketing at Legg Mason Global Asset Management.“Markets are typically forward looking, while investors are typically backward looking.”

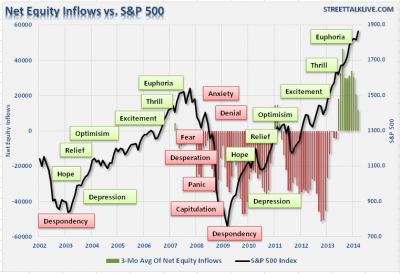

Investors are indeed backward looking as shown below. The Investment Company Institute (ICI) began tracking flows into equity funds in 2007 which I have overlaid with the investor psychology cycle. In this manner, you can witness investor behavior in “real time.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.