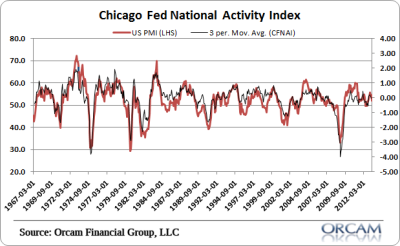

More bad signs here on the manufacturing front following this morning’s Chicago Fed National Activity Index release. The latest reading came in at -0.56 which brings the 3 month moving average to -0.04. This is the second consecutive negative reading and the third in the last 4 months. Current data is consistent with PMI readings that are basically hugging the expansion/contraction line.

Here’s a bit more detail from Econoday:

“Manufacturing has been hitting some bumps and is the major negative dragging down the national activity index in April which fell to minus 0.53 vs an already weak minus 0.23 in March. In both months, manufacturing production fell, down 0.4 percent in April following a 0.3 percent decline in March (manufacturing component in the industrial production report).

The consumer & housing sector has also been bumpy and is the second largest drag on national activity in April. On jobs, the better-than-expected April employment report failed to make much impact on the index as employment is neutral in the April report vs a fractional positive in March.

But stepping back, the weakness is concentrated in April and March, reflected in the 3-month average which is only marginally negative, at minus 0.04 in April vs minus 0.05 in March. A negative reading indicates that national economic activity is below historical trend, in this case just barely below.”

Chart via Orcam Investment Research:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.