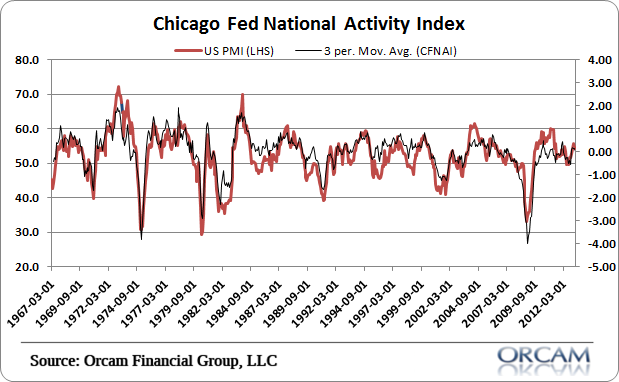

If this morning’s CFNAI reading was an indicator then we should expect continued sluggish economic growth. At -0.23 the index is consistent with modestly expanding PMI data (see chart below) and a weak economy. This brings the 3 month moving average to -0.1 which is not a terribly alarming reading nor a very positive one. I guess the good news is it’s not consistent with a contracting economy.

Here’s more details from Econoday:

“March, in contrast to February, was not a good month for the nation’s economic indicators. The Chicago Fed’s national activity index fell to minus 0.23 vs February’s upwardly revised plus 0.76.

A negative reading indicates that national economic activity is below its historical trend. March’s weakness pulled the three-month average from February’s plus 0.12 to minus 0.01.

The biggest change in March is in production indicators which still contributed to growth, at plus 0.01, but well down from February’s plus 0.47.

Helping to pull the index into negative ground during March was employment, at minus 0.06 vs February’s plus 0.31. Sales/orders/inventories fell to minus 0.02 from plus 0.13.

Consumption & housing pulled down the index down the most, at minus 0.14 for a second straight month.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.