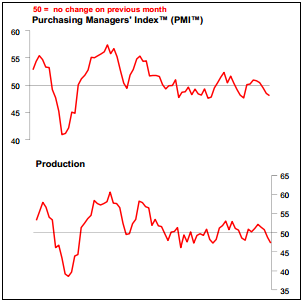

More signs of weakness in the Chinese economy as the PMI comes in lower than expected. This can’t be a good sign for global growth and especially emerging markets (via Markit):

Key points

- Flash China Manufacturing PMI™ at 48.1 in March (48.5 in February). Eight-month low.

- Flash China Manufacturing Output Index at 47.3 in March (48.8 in February). Eighteen-month low.

“The HSBC Flash China Manufacturing PMI reading for March suggests that China’s growth momentum continued to slow down. Weakness is broadly-based with domestic demand softening further. We expect Beijing to launch a series of policy measures to stabilize growth. Likely options include lowering entry barriers for private investment, targeted spending on subways, air cleaning and public housing, and guiding lending rates lower.”

Source: Markit

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.