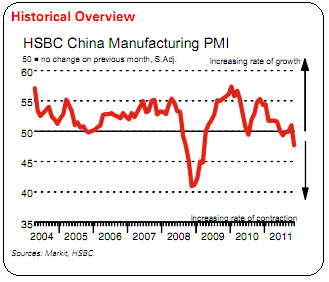

China’s economy is showing even slower growth than previously thought. Markit’s PMI showed a reading a 47.7 in November, worse than expected:

“November data showed Chinese manufacturing sector operating conditions deteriorating at the sharpest rate since

March 2009. Behind the renewed contraction of the sector were marked reductions in both production and incoming new business. The latest survey findings also showed a marked easing in price pressures, with average input costs falling for the first time in 16 months. In response, manufacturers reduced their output charges at a marked rate.After adjusting for seasonal variation, the HSBC Purchasing Managers’ Index™ (PMI™) – a composite indicator designed

to give a single-figure snapshot of operating conditions in the manufacturing economy – dropped from 51.0 to a 32-month

low of 47.7 in November, signalling a solid deterioration in manufacturing sector performance. Additionally, the monthon-month decline in the index was the largest in three years.”

Source: Markit, HSBC

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.