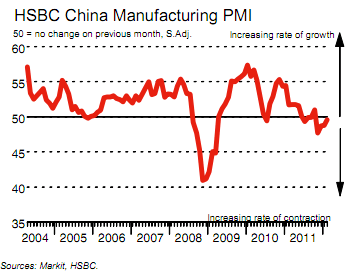

More signs of modest economic improvement in China as the hard landing scenario looks increasingly less likely. This morning’s PMI data came in at 49.6, still contracting, but an improvement from the 48.8 level last month (via HSBC):

“After adjusting for seasonal factors, the HSBC Purchasing Managers’ Index™ (PMI™) – a composite indicator designed to give a single-figure snapshot of operating conditions in the manufacturing economy – registered 49.6 in February, up from 48.8 in the preceding month, signalling a further worsening of manufacturing sector operating conditions. The latest index reading was nonetheless consistent with a marginal pace of deterioration that was the slowest in four months.

Commenting on the China Manufacturing PMI™ survey, Hongbin Qu, Chief Economist, China & Co-Head of Asian Economic Research at HSBC said:

“Growth remained flat on weakening new order intakes. Despite the marginal improvement in the headline PMI, led by quickening production and a recovery of hiring after the Chinese New Year, deteriorating external demand is adding more downside risks to growth in the absence of a strong comeback in domestic demand. We expect the PBoC to step up policy easing efforts as inflation pressures recede.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.