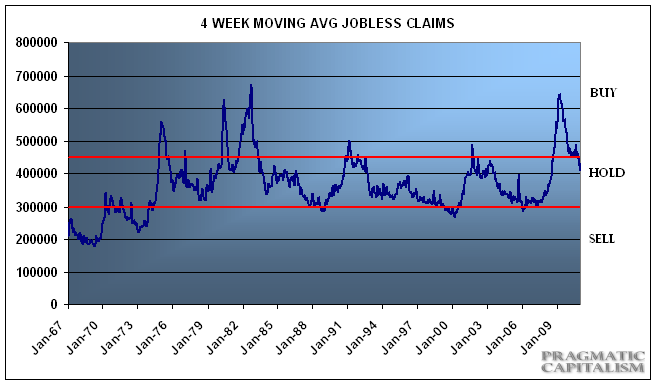

Jobless claims continued to dip this morning. The latest reading of 383,000 is the lowest level in 2.5 years. The deep thaw in the labor market continues though it is occurring at a snail’s pace. The four week moving average declined to 415,000. Continuing claims are down 47,000 to a two year low of 3.88MM. Stocks are down slightly despite the good news, however, claims have continued to display a very high correlation with equity markets.

As I have previously explained, this is a comforting data point for investors who don’t feel the need to check their investment account on a daily basis. In other words, the current level of claims, though no longer the screaming buy it was two years ago, is still consistent with a market that will push higher as labor conditions improve and slack in the economy is slowly reduced. It’s a recovery – not a good one, but it’s a recovery.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.