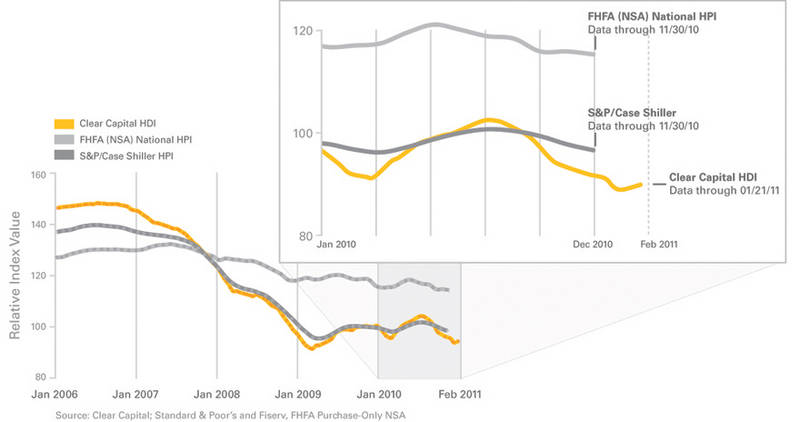

The latest housing report from Clear Capital shows some signs of life in the housing market (via Clear Capital):

The HDI Market Report provides the most current (through January 2011), granular and relevant analysis of how local markets performed compared to the national trend in home prices. Clear Capital’s latest release of its Home Data Index shows that U.S. home prices stopped declining in early January and have posted their first uptick since mid-August 2010.

“This recent national change in price direction is encouraging for the overall housing sector, yet it is still too early to determine whether this current uptick in home prices is a temporary reprieve or the start of a sustained recovery,” said Dr. Alex Villacorta, senior statistician at Clear Capital. “This uptick is the first non-incentivized change in prices we’ve seen since the downturn began, and could provide great opportunity for buyers, sellers and investors alike. Although many markets still remain under significant downward pressure in light of increased distressed sale activities, it is clear that the severity of the downturns observed in October and November have subsided.”

Turning of the Tide: Signs of upturn in U.S. home prices

Using sale transactions up through January, the HDI shows national home prices have turned the corner on their most recent decline. This change toward the positive for home prices is the first since mid-August, and signals the end of the pronounced price declines first observed by Clear Capital back in October and reported on more recently by the S&P/Case-Shiller 20 index as well as FHFA’s non-seasonally adjusted national index. Furthermore, this observed change in prices is especially meaningful as the first months of the year are typically affected by the seasonal slowdown in sales activity, suggesting that buyer demand may be returning in anticipation of a potential start to a sustained recovery.

Prices Experience Positive Start to 2011

- Since Jan. 1, 2011, national home prices have experienced the first positive gains since mid-August 2010 (0.9% in the first three weeks of 2011).

- National quarterly decline of 1.6 percent is a significant improvement from November’s quarterly decline of 5.8 percent, further indicating a halting of price drops.

- The year-over-year national decline continued downward, but only marginally, with the yearly price change reaching -4.3 percent through January, down from the -4.1 percent reported last month.

Source: Clear Capital

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.