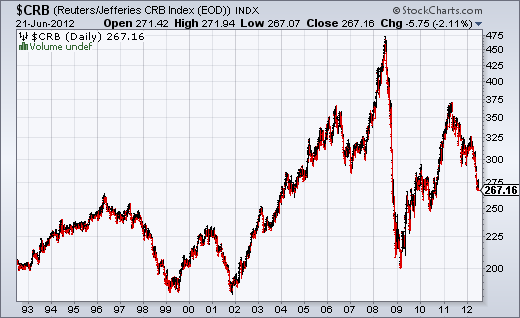

Remember all those calls for hyperinflation following QE2 and how all that “money printing” was going to wreak havoc on global prices? Well, prices have sure been wrecked, but in the exact opposite direction of a hyperinflation. If you recall the panic following QE, we had widespread fears of hyperinflation even leading Chinese farmers to hoard commodities in their kitchens. And now, 21 months after QE2 first sparked these fears were are again on the precipice of deflation. And commodity prices have made a complete round-trip after having surged in the months following this “money printing”. See the chart below which shows the 20 year compound annual growth rate of 1.5% for commodities!

I only point all this out because I took a great deal of flak for claiming that QE was not “debt monetization” or explaining that QE would be a monetary non-event for the broader economy. And while it’s a stretch to claim the policy has had zero impact on the economy, it’s not a stretch to note that QE did not cause widespread inflation or anything remotely resembling hyperinflation. A few trillion in extra bank reserves hasn’t caused high inflation. How could that be? Well, the fact that it’s a simple asset swap that doesn’t change the net financial assets of the private sector is a good starting point. Understanding the operational realities of the modern monetary system is probably a better starting point though.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.