First it was Chinese cotton farmers hoarding cotton in their kitchens. Now it’s Chinese trading firms using copper as collateral for financing business deals. This latest note from Standard Chartered (courtesy of FT Alphaville) just wreaks of bubbly commodity madness:

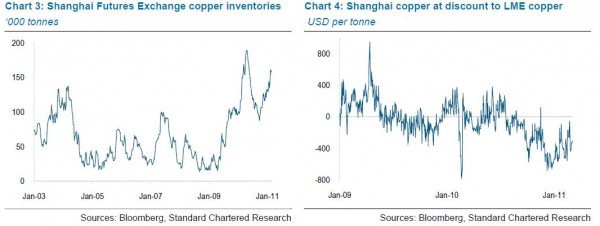

Warehouse sources report substantial volumes of copper inflows after the Chinese New Year holiday. A very small proportion of this copper has been sold to the domestic market so far. Chart 4 shows that Shanghai copper has been trading at a significant discount to LME copper since October 2010, reflecting pressure from increasing stock levels.

With more material available, trading firms have been diverting metal into finance deals and using copper as collateral. Copper tied to these deals will be released to consumers, but only when demand picks up more decisively. We estimate that roughly 550kt of copper was stockpiled in bonded warehouses in Shanghai in late February, the majority of which is tied to financing deals.

The Americans started the financialization of everything, but the Chinese appear to be attempting to perfect it….In the end, their speculative mania is certain to end the same way all American bubbles have ended….The Chinese have adopted many facets of capitalism from their Western economic textbooks. Unfortunately, they’ve adopted many of the very worst parts….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.