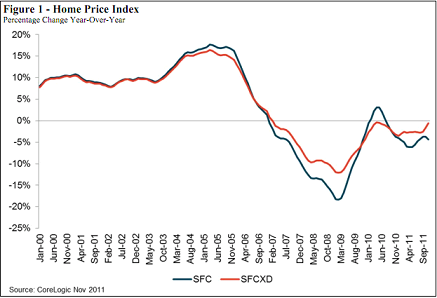

Despite some mildly good news in recent home sales data, prices continued to decline in November according to Corelogic:

“CoreLogic (NYSE: CLGX), a leading provider of information, analytics and business services, today released its November Home Price Index (HPI) report, the most timely and comprehensive source of home prices available today, which shows that home prices in the U.S. decreased 1.4 percent on a month-over-month basis, the fourth consecutive monthly decline. According to the CoreLogic HPI, national home prices, including distressed sales, also declined by 4.3 percent on a year-over-year basis in

November 2011 compared to November 2010. This follows a decline of 3.7 percent* in October 2011 compared to October 2010. Excluding distressed sales, year-over-year prices declined by 0.6 percent in November 2011 compared to November 2010 and by 1.6* percent in October 2011 compared to October 2010. Distressed sales include short sales and real estate owned (REO) transactions.

“With one month of data left to report, it appears that the healthy, non-distressed market will be very modestly down in 2011. Distressed sales continue to put downward pressure on prices, and is a factor that must be addressed in 2012 for a housing recovery to become a reality,” said Mark Fleming, chief economist for CoreLogic.”

Source: CoreLogic

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.