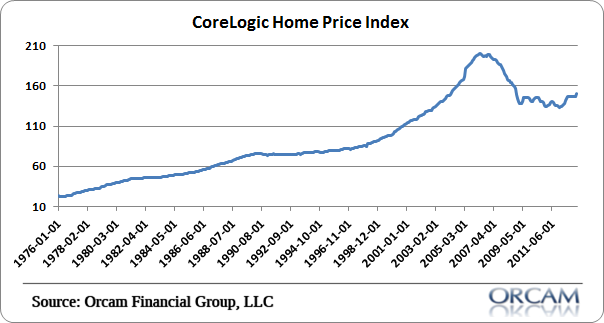

The latest CoreLogic housing report showed big gains in year over year housing prices. National home prices are up 10.5% year over year and 1.9% versus February. Prices are still 25% below the 2006 peak, but making a solid move off the 2011 lows which were 13% lower than today’s values.

According to CoreLogic the pace of appreciation is likely to move lower in the coming months, but remain in the high single digit levels. Comps will become increasingly difficult as we head into the summer months so expect this index to reduce the pace of gains as we head into July and August.

Mark Fleming, CL’s Chief Economist added some color:

“For the first time since March 2006, both the overall index and the index that excludes distressed sales are above 10 percent year over year. The pace of appreciation has been accelerating throughout 2012 and so far in 2013 leading into the home buying season.”

Chart via Orcam Investment Research:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.