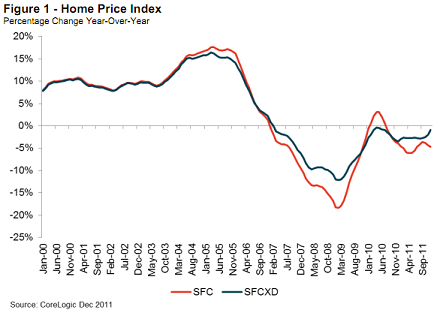

The recent Case Shiller data showed a continuing decline in home prices in November and now the latest Corelogic data is showing declines in December. Clearly, the real estate remains very weak despite better than expected data in recent weeks:

“SANTA ANA, Calif., February 2, 2012––CoreLogic (NYSE: CLGX), a leading provider of information, analytics and business services, today released its December Home Price Index (HPI®) report, the most timely and comprehensive source of home prices available today, giving the first look at full-year 2011 price changes. The CoreLogic HPI shows that, including distressed sales, home prices in the U.S. decreased 4.7 percent in 2011 compared with December 2010. This year-end report shows that home prices continued the trend of year-end decreases—this is the fifth consecutive year with a decrease in the HPI. The HPI excluding distressed sales shows that home prices decreased by 0.9 percent in 2011, giving an indication of the impact of distressed sales on home prices in 2011.

‘While overall prices declined by almost 5 percent in 2011, non-distressed prices showed only a small decrease. Until distressed sales in the market recede, we will see continued downward pressure on prices’ said Mark Fleming, chief economist for CoreLogic.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.