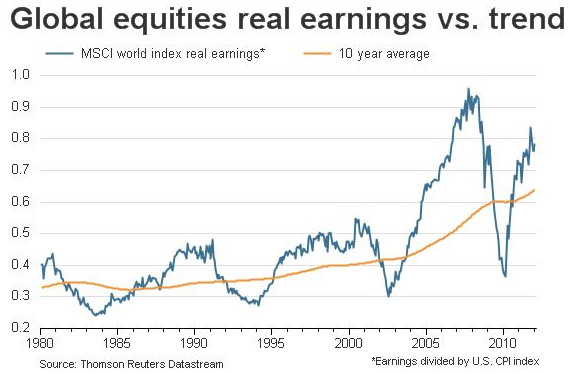

Here’s a nice big macro trend chart from Thomson Reuters that shows global earnings versus the trend. The chart shows the tendency to revert to the mean in a typical manic market fashion. Of course, as is always the case, timing is everything. One thing we know is that because budget deficits drive corporate profits we can probably expect no mean reversion in 2012 in the USA. This is from Reuters:

“As the chart above demonstrates, while company earnings can remain above that trend line for some time, there is an unsurprising tendency on their part to revert to the mean eventually – and not infrequently overshoot on the downside. So if February is drawing to a close on a note of cautious ebullience, perhaps that is exactly the feeling that the fundamentals – as depicted in this series of charts – calls for.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.