By Walter Kurtz, Sober Look

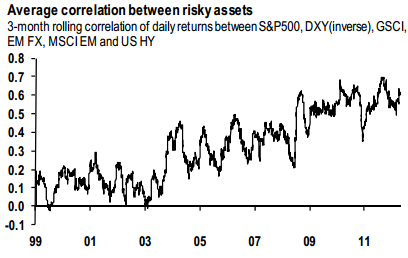

Over the past decade (and some would argue longer) average (pairwise) correlation among “risk assets” has been on the rise (see figure 1).

A number of possible causes for this trend have been proposed. So far JPMorgan’s write-up on the topic from over a year ago still provides the most reasonable explanation.

“JPMorgan (May-2011): – Globalization of capital markets, and new risk-management and alpha extraction techniques have driven the secular increase of cross-asset correlations. “

This means that global macro events increasingly drive world financial markets, as investment professionals focus more on central banks than their specific investment mandates. Trading between “risk-on” and “risk-off” dominates valuations across asset classes. Consistent “alpha extraction” is becoming far more difficult and the choice of beta (risk appetite) rather than investment selection differentiates fund managers. The following quote describes quite well the investment climate dominated by rising correlations across risk assets.

“JPMorgan (27-Jul-12): – Many investors say they lack conviction, and find it harder to gauge value and market direction amid so much political uncertainty. This uncertainty is breeding inactivity. The steady rise in correlation between risk assets is making it harder to find diversified sources of alpha. US equity managers are having their worst year since 1995 in trying to beat the S&P500, underperforming on average by 1.11% YTD. Hedge fund managers have delivered only some 2% YTD, after fees, pushing them way down in the YTD return hit parade. This lack of active returns is forcing many to stay close to their benchmark and to take less risk.”

(Figure 1 – Source: JP Morgan)

(Figure 1 – Source: JP Morgan)

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.