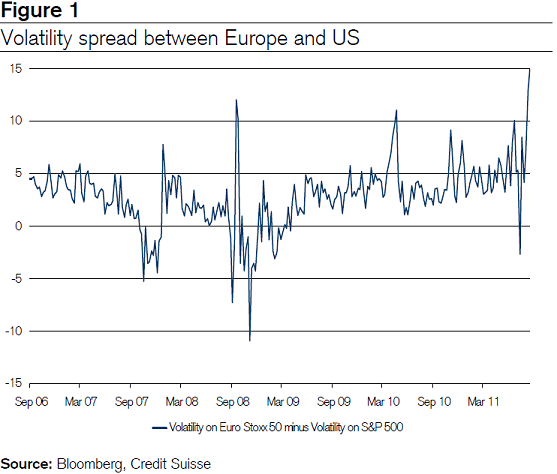

Credit Suisse is recommending that investors sit tight as volatility is likely to persist. They say the uncertainty in the markets is likely to continue as the Europeans fail to put together a clear solution to the Euro debt crisis. They provide an interesting perspective on Global volatility which shows that the current environment is potentially more volatile than the 2008 crisis (see image below). They’re not recommending additional equity positions at this juncture:

“As long as there are no convincingly clear positive catalysts stemming from macroeconomic data points and statements/actions from European politicians, we think that this market regime is likely to continue. And there will be continued volatility in a fairly fragile environment, where any news items regarding the European and US economic/sovereign situation is likely to lead to significant swings in equity prices.

We recommend investors with a neutral position in equities not to take any action and wait, while investors which are

overweight, and which have a longer investment horizon, should maintain their overweight position.”

Source: Credit Suisse

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.